Household fresheners are enjoying a period of rapid innovation, with new fragrances, new formats and new participants in the overall market. Fresheners have moved on from being a functional product designed to cover unpleasant smells, into being a more integral part of improving the general ambience of the home.

Household fresheners are enjoying a period of rapid innovation, with new fragrances, new formats and new participants in the overall market. Fresheners have moved on from being a functional product designed to cover unpleasant smells, into being a more integral part of improving the general ambience of the home.

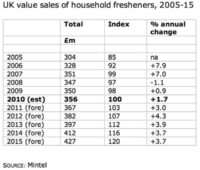

Looking at sales between 2005 and 2010, the first three years of this period saw heady growth, driven by innovation, especially the introduction of powered fresheners. In 2008 there was a small dip in sales because of weak consumer confidence and high levels of promotional discounting in the supermarkets, but the market returned to growth in 2009 and 2010 helped by innovative products and new fragrances.

The trend for stay-at-home leisure has helped grow demand, encouraging consumers to improve the ambience of the home, both for themselves and in preparation for visitors and guests.

Sales of household fresheners grew by 17% over 2005-10 to reach £356 million. Growth has been driven by innovation, especially the introduction of powered fresheners and new fragrances. Indeed, innovation in the sector is high. According to Mintl GNPD, in 2009, there were 177 new products or variants launched onto the market, making this the highest level of NPD over 2006-09. Non-powered air fresheners (including reed diffusers) and candles accounted for the highest amount of NPD activity

Own-label is a significant force in household fresheners and accounts for some 18% share of the whole market. Growth of own-label brands outstripped the market as a whole over 2008-10. Own-label sales grew 6% over 2008-10 to £62.5 million. At the same time market growth was a little under 3%.

According to exclusive consumer research, in the UK two thirds of households (65%) use household fresheners. All socio-economic groups use fresheners, although C2DEs are the heaviest users. Household fresheners are used by 61% of adults, and 24% use scented candles.

The main factors influencing choice of household fresheners are scent (51%), promotions (28%), performance (27%), brand (23%) and low price (23%). Under 35s are more inclined to go for the cheapest options, are less brand loyal and will buy products that attract more loyalty points.

Comments are closed.