While the market for “Premium Soft Drinks” has just hit the £100m barrier, latest research into premium soft drinks highlights low awareness as a key industry problem. Indeed, according to exclusive consumer research, around a fifth of the population have not heard of any brands within the sector, while only the long-established brand leaders (Shloer and Appletiser) are recognised by more than half the population.

While the market for “Premium Soft Drinks” has just hit the £100m barrier, latest research into premium soft drinks highlights low awareness as a key industry problem. Indeed, according to exclusive consumer research, around a fifth of the population have not heard of any brands within the sector, while only the long-established brand leaders (Shloer and Appletiser) are recognised by more than half the population.

Premium soft drinks are upmarket, adult soft drinks which usually come in premium packaged glass bottles and generally contain natural, more unusual and better quality ingredients. Examples include Shloer’s white grape and elderflower juice and Belvoir organic ginger beer.

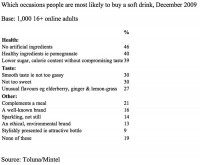

Today’s consumers (and not just women) are increasingly concerned with consuming healthy and natural ingredients, and Mintel’s research shows almost half of adults are prepared to pay a premium for it when buying soft drinks. As ABC1s rise, so the population has become more aspirational, and around seven in ten now think it is “worth paying extra for quality goods”. In other drinks markets, this has driven growth of premium coffee, whisky and vodka, to name a few.

Health benefits are most likely to persuade consumers to dig deeper into their pockets. For example, 18 million UK consumers would be willing to pay more for a soft drink with natural ingredients; while, 16 million would do so if the drink contained healthier ingredients; or if there was low sugar/calorie content without compromising taste.

The off-trade is responsible for the vast majority of sales, exacerbated by cash-squeezed consumers staying in more. However, there is considerable potential in the on-trade. Pubs are becoming more and more food-led, and there is huge consumer demand for better quality and healthier drinking options. Indeed, targeting mealtime occasions either in-home or the on-trade is a prime opportunity. For example, 20 million UK adults are most likely to buy a soft drink to accompany a meal in pubs/bars/ restaurants, with 18 million doing the same for meals at home.

Supermarkets have been slowly increasing the amount of shelf-space allotted to premium soft drinks, with online supermarket Ocado responsible for 30% of all stock sold (according to mysupermarket.com). Discounting in supermarkets has become much more frequent in 2009, from April onwards (according to data from mysupermarket.com).

In 2009, the market was worth £105 million and is expected to grow by a quarter in value sales over the next five years.

Key to growth will be its ability to further infiltrate the on-trade, where there is huge demand for a better soft drink proposition. This has proved difficult for smaller companies, with Britvic and Coca-Cola (CCE) dominating pub distribution.

However, the vast majority of sales come through the off-trade, and in particular supermarkets. However, the low awareness of all but the main premium soft drinks brands – Shloer and Appletiser – is currently inhibiting supermarket sales as people opt for well-known brands. The danger is that the market will become increasingly reliant on discounts to shift sales, which will damage its long-term saliency.

Comments are closed.