- Grocery sales made online in the last four weeks ending 11th July have grown by 115% compared to the same period last year

- Online now accounts for 14% of all FMCG sales, up from 13% last month

- UK shoppers spent £49 billion on FMCG products during the full 16 week lockdown period, an additional £3.2 billion in FMCG spend

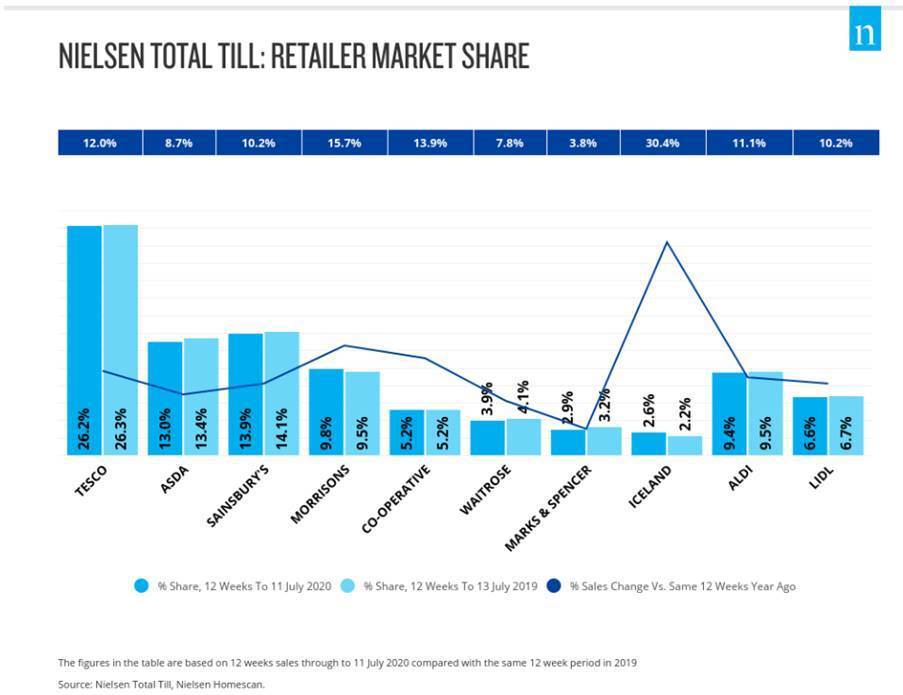

The figures in the table are based on 12 week sales through to 11 July 2020 compared with the same 12 week period in 2019 Source: Nielsen Total Till, Nielsen Homescan

Online share of sales accounted for 14% of all grocery spend in the UK in the last four weeks ending 11th July 2020. This is up from the 13%1 share recorded in the previous four weeks, and 10% share from May 2020, and is the highest figure for UK grocery spend online to date, reveals new figures released today by Nielsen.

Nielsen data shows that online sales in the last four weeks ending 11th July grew by 115% compared to the same period last year. Overall total till sales growth slowed to 10% as the UK exited the lockdown period.

In the last four weeks ending 11th July, there was significant growth in the alcohol categories, with sales of beers, wines and spirits up by 31%, whilst frozen grew by 19% and meat fish and poultry saw a rise in sales by 15%². All of this was helped by the heatwave, encouraging shoppers to eat outside, have a BBQ and enjoy the weather.

Lockdown boosts convenience stores

Looking at the last 16 weeks, the full lockdown period in the UK, Nielsen data shows that UK shoppers spent a total of £49 billion on groceries, tobacco and general merchandise. This represents an extra £3.2 billion at UK supermarkets overall when compared to the same period last year. It also displays significant behavioural changes in consumers’ shopping habits, with visits going down and basket size going up. Moreover, Nielsen data shows that significantly, 47% of this incremental spend during the lockdown period was made at convenience stores³.

This extra spend, coming from ‘stockpiling’ behaviours as well as spend diverted from closed restaurants and pubs, may well continue to some extent if shoppers remain cautious about eating out and travel.

Retailer performance

Over the last 12 weeks, Morrisons (sales growth of 15%) was the best performing of the ‘big four’ retailers. Iceland (+30.4%) and Co-op (+13.9%) also continued to perform well, as shoppers focussed on purchasing frozen food and preferred to shop at local and convenience stores.

As demand for groceries returns to normal levels, Nielsen data shows that promotional spend is slowly increasing in recent weeks. This now accounts for 20%¹ of all spend, up from 16% at the start of lockdown. However, this is yet to reach the same levels as the same time last year (27%).

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “The lockdown was a period of planned, precise and predictable spend, as shoppers focussed on stocking up on the necessities – often buying more than was essential to ensure against any perceived threat of shortage or inability to go shopping. Following the reopening of pubs and restaurants on 3rd July, the economy is now fully open for business and we are waiting to see how shopping behaviour will evolve.”

Watkins continues: “The stalwart of the lockdown period was online grocery and there’s no signs yet that demand will slow. Shoppers also shifted a lot of their spend to convenience channels, preferring to do some of their big shop in smaller stores – possibly because of the need to remain close to home during the lockdown period.”

Watkins concludes: “There are four major factors that will affect grocery shopping as we now exit lockdown. Though restaurants and pubs have reopened, we expect grocery sales to continue growing, as there remains a degree of caution when it comes to dining out. The demand for ‘staycations’ will also boost usual summer grocery levels as customers opt to stay at home or holiday in the UK. If the weather stays warm, this will be a boost for the supermarkets. Yet, we must be aware of the looming recession – this could place a lot of strain on consumers and where they focus their spend. With consumer confidence down 18 points in Q2 of 2020 (the lowest level it’s been since Q4 2013) and only 24% of consumers feeling positive about their job prospects?, retailers must be aware of the changing circumstances of customers.”

Unless otherwise stated all data is Nielsen Homescan Total Till

1Nielsen Homescan FMCG Total GB

2 Nielsen Scantrack Grocery Multiples

3 Nielsen Total Coverage

?The Conference Board® Global Consumer Confidence Survey conducted in collaboration with Nielsen”.

Comments are closed.