Supermarket sales have slowed to +7%, as shoppers began to truly settle into new shopping routines, post lockdown. The warm weather, coupled with Brits working from home, spending less on dining out and embarking on UK ‘staycations’ over the summer have all contributed to this steady growth in UK grocery sales over the four weeks ending 8th August 2020, compared to the 1% growth during this same period last year, reveals new data released today by Nielsen.

Nielsen data shows that in the last four weeks to 8th August 2020, Brits spent £678m more on FMCG at UK supermarkets than during the same period last year. Online sales accounted for 97% of this growth – a total of £658m – as sales made in-store were only up by £20m1. Over the last four weeks, in-store sales growth overall remained flat at +0.3% but online grocery growth continued to accelerate, up +117%, maintaining its 14% share of all FMCG sales.

Brits have also rekindled their love of baking in the last four weeks, with data from Nielsen showing a surge in baking products such as flour (+47%)², sugar and sweeteners (+25%), eggs (+17%) and butter and spreads (+14%). This is likely due to a rise in families cooking together with the children as part of ‘staycations’ during the summer school holidays. This is supported by the rise in demand for fresh meat, fish and poultry (+13%) and packaged grocery products (+14%) which has surpassed sales of frozen food (+12%) for the first time since April. Sales of beers, wines and spirits also increased by 20%.

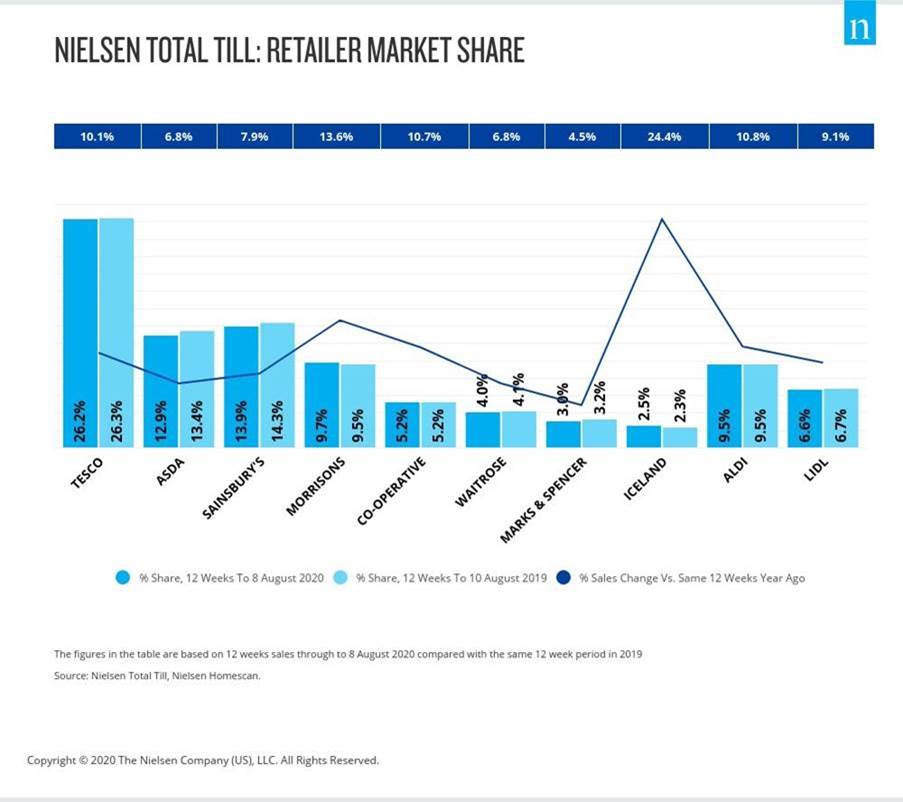

In terms of retailer performance, Morrisons (+13.6%) continues to outperform the other ‘big four’ UK supermarkets and increase market share, but Iceland (+24.4%) has the strongest growth overall. The discounters Aldi (+10.8%) and Lidl (+9.1%) also show signs of steady growth – which, in their case, is coming almost entirely from in-store sales.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “It is evident that some new shopping habits that developed as a result of the pandemic – such as opting to shop online – continue. UK shoppers are now establishing a new, regular shopping routine and we can expect the current levels of growth to continue for the rest of the summer. Shoppers are still shopping less often than they did prior to the pandemic, visits to stores are down 15% on the same period last year, but up from the 22% decrease registered in May, so there are signs of a willingness to return.

Watkins concludes: “The shift to online grocery shopping, which looks set to stay, is the most dramatic change of shopping behaviour we’ve ever seen. Though it has clearly been a positive gamechanger for shoppers and some retailers, it has come at the expense of stores – something that we have already seen in non-food retailing.”

Comments are closed.