- Total Till grocery sales at UK supermarkets continue to improve with sales up 1.5% in the last four weeks ending 18th June 2022

- Volumes decline by 5.5% at supermarkets as shoppers manage basket spend in response to the rising cost of living

- Shoppers shift to cheaper meal alternatives with sales up for frozen poultry (+12%), rice and grains (+11%), canned beans and pasta (+10%) and gravy/stock (+9%)

Total Till grocery sales at UK supermarkets have continued to improve, with sales up 1.5% for the four weeks ending 18th June 2022, reveals new data released today by NielsenIQ. However, despite this uplift, volume sales are declining by 5.5%, as shoppers seek to manage their basket spend as a result of inflation and the rising cost of living. 1

Warmer weather last year and still cautious shopping habits both led to tougher comparatives over the last four week period. However, the uplift in sales was boosted by The Queen’s Platinum Jubilee celebrations, which took place during the week ending 4th June. Sales during this period were buoyant at +3.7%, with growths across teatime treats and fizz, such as cream and custard (+48%), champagne (+47%), dough and pastry (+46%), sparkling wine (+40%) )1.

Sales were also boosted during the week ending 18th June at +0.7% where Brits experienced the first spell of hot sunny weather and the hottest temperatures so far this year. In absolute terms, NielsenIQ data shows that shoppers spent £10.4bn at UK supermarkets in the four weeks ending 18th June, compared to the £10bn spent in May, with more of this spend switching to the discounters.

Data from NielsenIQ shows that while inflation is now helping to lift category growths across most of the store, volume sales were in decline in all FMCG categories at the UK supermarkets over the last four week period. Moreover, rising prices are leading shoppers to consider cheaper meal alternatives, with sales increasing for frozen poultry (+12%), rice and grains (+11%), canned beans and pasta (+10%), gravy/stock (+9%) and canned meat (+9%). Whilst sales of Dry Pasta increased 31%. In contrast, sales of beers, wines and spirits (still impacted by the slow reopening of the hospitality industry a year ago) fell 9.7%, as well as general merchandise falling by 6.1% as shoppers trimmed discretionary spend.

NielsenIQ data shows that in the four week period, visits to stores grew 7% – which is over 31m extra visits than this time last year. However, online sales fell 12% compared with last year, with almost half a million fewer online shoppers than in June 2021. As a result the online share of all FMCG sales has reduced to 11.3% from 11.7% in May and 13.1% a year ago. 2

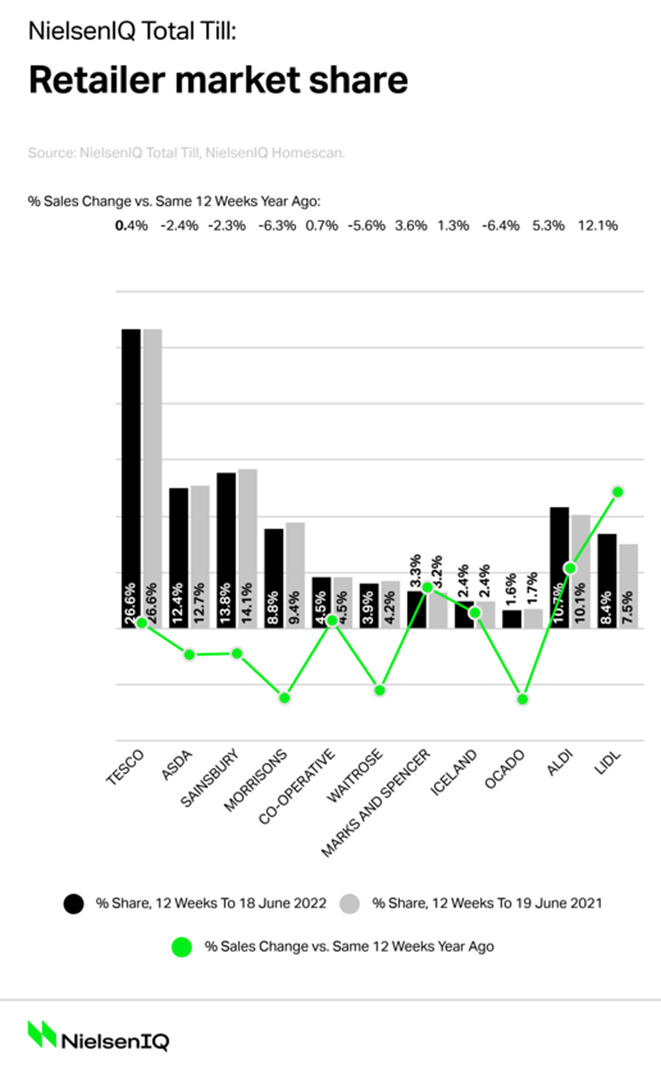

In terms of retailer performance, M&S continues to have strong momentum, with 1 in 5 households shopping at M&S in the last four weeks, which was helped by the warm weather and celebrations. Moreover, Tesco is the only one of the ‘big four’ supermarkets to grow. However, it is Aldi and Lidl who are still the fastest growing food retailers and their combined market share has now hit 19.1%.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “It is no surprise that with budgets squeezed some households are less willing or less able to spend on a large online shop. Moreover, with no restrictions on visiting stores, this is encouraging shoppers to shop around for the best prices as well as shopping little and more often to help manage the weekly food budget. Shoppers are starting to make different choices in how to compensate for their rising cost of living. For some households, the way to save money is to buy cheaper products and our analysis suggests that some of the increased cost of an overall basket can be mitigated in this way3.”

Watkins continues: “For one in four households this goes further and includes monitoring the overall cost of their shopping basket, opting for private label, waiting for their preferred products to be on offer or seeking out their favourite brands at value retailers such as Home Bargains, B&M or Poundland. According to NielsenIQ data, for the 15% of households who now consider themselves to be ‘strugglers’, almost a quarter of this cohort will stop buying certain products altogether and 28% will shop more at Aldi and Lidl. 3”

Watkins concludes: “The outlook for the next four weeks is for further pressure on shopper spend and whilst there are some major sporting events over the next few weeks, such as Wimbledon, the F1 and the Women’s Euros, incremental volume growths to the end of July will probably remain subject to the vagaries of the weather. And in the meantime, as shoppers remain cautious, retailers will continue to offer differential price cuts and savings for their most loyal shoppers.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Comments are closed.