- 24% of all FMCG sales were items on promotion in the last four weeks, rising to 35% for branded items (up from 31% a year ago) and 16% for own-label (up from 13%)

- Online channel maintains a higher share of all FMCG sales growth (+7.9%), ahead of in-store growth (+3.8%), however in-store visits are up (+0.9%) compared to last year

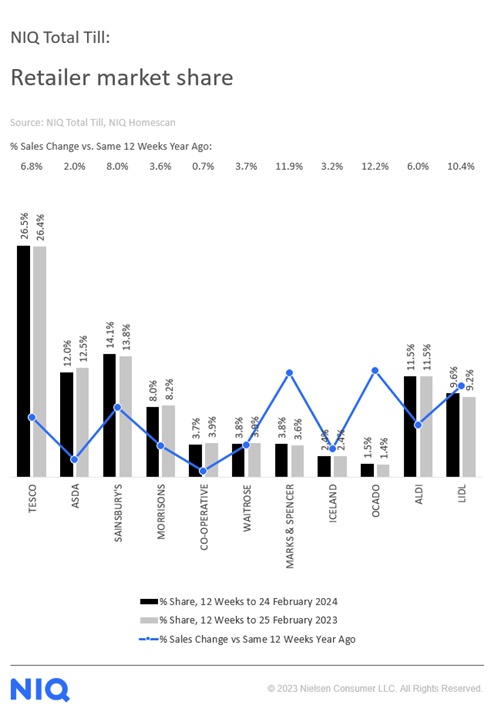

- Ocado (+12.2%) is the fastest growing retailer over the last 12 weeks, followed by M&S (+11. 9%) with sales momentum continuing to slow for the discounters

Total Till sales at UK supermarkets slowed (+5.3%) in the last four weeks ending 24th February 2024, according to new data released today by NIQ. This is a slight slowdown compared to the growth (+6.6%) reported last month, a result of food inflation falling to 5%1.

However, grocery retailers capitalised on big events like Valentine’s Day, Pancake Day and the Chinese New Year to attract shoppers through promotional offerings. Data from NIQ reveals that this strategy likely played a part in boosting shopper spend on promotions. In the last four weeks, 24% of all FMCG sales were bought on promotion, rising to 35% for branded items (up from 31% a year ago). Sales of supermarket own-label goods also increased to 16% compared to 13% last year.

NIQ data also reveals that online channel growth (+7.9%), remains ahead of in-store (+3.8%) with the online’s market share up to 11.2% compared to 10.8% this time last year. However, despite February being the warmest and wettest on record in the UK, NIQ data shows shoppers increased their in-store visits (+0.9%) compared to last year2.

NIQ has identified four key category trends since the start of 2024. The first is shoppers buying convenient meal options which is reflected in strong growth in the last four weeks for prepared fresh meat products (+13%), frozen chips (+13%), cooking sauces (+7%) The second key trend is cheaper meal ingredients; rice & grains (+13%), canned veg (+10%) and frozen poultry (+8%). The third is a shift towards healthier snacking with growths in dried veg & pulses (+23%) and fresh prepared fruit (+7%).

And finally, the fourth key trend was events. With Pancake Day taking place in February, there was also a rise in sales for baking ingredients such as baking mixes (+24%), flour (+18%), eggs (+16%), golden syrup (+29%), and chocolate spread (+27%) during the week ending 17th February3.

In terms of retailer performance over the last 12 weeks, Ocado (+12.2%) was the fastest growing retailer followed by M&S (+11.9%), while sales momentum at discounters Lidl (+10.4%) and Aldi (+6.0%) continues to slow. Sainsbury’s (+8.0%) and Tesco (6.8%) both experienced an increase in market share with slower growth at Morrisons (+3.6%) and Asda (+2.0%).

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “Whilst industry volumes remain positive, many brands are now chasing growth having lost category share during the high period of inflation and are keen to communicate their own value among consumers. We expect the levels of promotion to continue to creep up over the next few months. Brands are also going to be important to sustain the recovery in FMCG spend and with Euro 2024 and Paris Olympics on the horizon, branded promotions will be the drivers of increased discretionary spend post Easter.”

Watkins adds: “The resilience of online grocery shopping during the highest period of inflation in decades, when household penetration fell a little, is due to the changed lifestyles of consumers. When food inflation was in double digits, shoppers did cut back on large ‘trolley’ shops and online was also impacted. Whilst this growth is now against a weak comparative (-2.5%), it is also a normalisation of shopping behaviour for the one in four households who continue to shop this channel every four weeks and suggests that omnichannel shopping in food retail is here to stay.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Unless otherwise stated all data is NIQ Homescan Total Till

1 BRC NIQ SPI

2NIQ Homescan FMCG

3NIQ Scantrack Grocery Multiples

Comments are closed.