Kepak Convenience Foods has played the major role during the last decade in building the UK hot snacking market and making retailers appreciate its importance, and they don’t look like they’re through just yet.

Kepak Convenience Foods has played the major role during the last decade in building the UK hot snacking market and making retailers appreciate its importance, and they don’t look like they’re through just yet.

Kepak’s first success was with the Rustlers brand, which is now heading for a place in the top 100 UK grocery brands, and whose ease of use, backed by irreverent advertising, has made it an instant hit with its target market, young males aged 16-24.

Rustlers has been followed in recent years by Zugo’s Deli Café, the café-style hot panini range which is aimed at a slightly older audience as a lunchtime hot snack, and is gaining popularity with older consumers of both genders. And the Rustlers range extension Rustlers Hot Subs and Hot Wraps are both introducing new consumers to hot snacking.

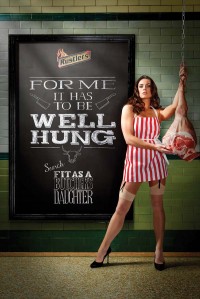

Having won over Britain and Ireland, Kepak is now making inroads into Continental Europe with its brands, and has plans for further geographic expansion. Meanwhile Kepak continues to delight Rustlers’ core audience here with its myth-busting online campaign “Fit as a Butcher’s Daughter,” underlining the quality message about the meat used in the Rustlers range and featuring butcher’s daughter Lexi O’Leary, who likes her meat ‘well hung’.

Taking the story into the next chapter, they have big plans for the UK this year, including limited editions on Rustlers and major projects for next year. The Grocery Trader caught up with John Armstrong, Marketing Director of Kepak Convenience Foods on a recent visit to London.

The Grocery Trader – John, we last spoke about a year ago. What’s been happening in the business since?

The biggest development is our acquisition of the Eatwell brands, which have added scale and increased production at our Preston factory, giving us stability and added momentum, enabling us to plan better for the future.

GT – How has 2012 been for you so far?

2012 has been a double-edged sword: we’ve seen great growth and gained distribution, which has given us momentum. The flip side is that global beef demand has also gone up, and prices remain at record levels with no early signs of getting back to where they were before. We use the same meat in our products as is used for mince; we haven’t cut corners. We’re also trying to offset costs through investment in factory efficiency.

2012 has been a double-edged sword: we’ve seen great growth and gained distribution, which has given us momentum. The flip side is that global beef demand has also gone up, and prices remain at record levels with no early signs of getting back to where they were before. We use the same meat in our products as is used for mince; we haven’t cut corners. We’re also trying to offset costs through investment in factory efficiency.

GT – Have you put your product prices up?

Yes we have, out of necessity, but we have kept increases as low as possible. For example, in the convenience sector Rustlers Quarter Pounder has risen from £1.89 to £1.99. In grocery, the multiples’ prices have risen by varying amounts.

GT – What’s been your favourite moment in business in the last 12 months?

There have been many. On the creative side, it was fun attending a photo shoot with Lexi O’Leary, the butcher’s daughter. On a more serious note, we won The Grocer’s Chilled Supplier of the Year Award, for the third time in the last four years. It’s recognition of how we service the trade: we put great value on these things.

GT – You’ve talked before about Kepak’s insights into the dynamics of hot snacks shopper behaviour. What trends are you seeing?

In terms of overall trends the ‘value’ piece is really important, and we need to keep adjusting our offer. We’ve seen major activity in Pot Meals, which includes Zugo’s Pasta – there were just a couple of premium brands before, and now there are growing numbers of products, similar to the situation on the Continent.

GT – What effect is the continuing tough UK economic environment having on purchases of hot snacks?

Hot snacks aren’t recession proof, but the market has clearly been growing in value: volume is also up 3.5%. The multiple trade is focused on giving shoppers value, and we’re working with them to help achieve it, for example with twin-packs and four-packs in different accounts.

GT – How are you responding to the downturn in terms of NPD and marketing activity?

We’re maintaining high levels of investment in marketing support. Multi-packs have been our main NPD addressing the downturn: one of our focuses for 2013 will be bringing out a value stream. We look closely at what’s happening in foodservice and such things as McDonald’s Saver Menu and Subway’s smaller products, and see what we can do in retail.

GT – There’s clearly a lot going on in the company. What does your typical working week involve?

I typically spend three days in the UK, one in Ireland and one elsewhere in Europe.

GT – Who else is on the marketing team these days?

We’ve added some new European marketing people. Mike Lorimer and Annette Heyes support me in looking after the UK: on the European side we have Ruth Cosgrove aided by Orlaith Sweeney, a languages and business graduate.

We’ve added some new European marketing people. Mike Lorimer and Annette Heyes support me in looking after the UK: on the European side we have Ruth Cosgrove aided by Orlaith Sweeney, a languages and business graduate.

GT – Have you been investing in your factory in Kirkham and taking on more people?

We’re investing in people and machinery to increase our production capacity, with more CAPEX planned for 2013. We’re also looking at our new equipment needs for the next three years.

GT – How are the different brands doing?

Rustlers are up +18% and Zugo’s up 16%. Rustlers are still the biggest part, worth £73m in the UK. Zugo’s distribution gains have helped, and it should go above £10m by year-end, assisted by an active NPD programme and media spend. Rustlers Hot Subs and Hot Wraps are also now both well established – and set for continued growth.

GT – How near is Rustlers to breaking into the Top 100 UK brands?

Last year the Top 100 barrier was £85m, so on this showing we could do it in a year’s time. People are surprised when we quote numbers: being in the Top 100 would definitely enhance our brand credential.

GT – You bought the Feasters brand last year. Are there any plans for promoting the Feasters brand above the line?

Not at the moment: Feasters is currently only in Asda. We’ve improved the range and given it new packaging from September. The quality has also improved since we’ve been cooking the burgers. We’ve taken on over 100 new people since we bought Eatwell, and now employ 440 staff in total, confirming Kepak as a major employer in the North West.

GT – Are you seeing a clear market emerging in the UK for lunchtime hot snacks, based on purchases by adult office workers and others?

Yes, we are, with more lunch offerings appearing from the big brands. Our main weapon is the Zugo’s brand, and as we build distribution for Panini and Pot Pasta the market will come. We’ve also seen lunch business for Rustlers Wraps. In our research with Kantar looking at hot meals prepared in under 10 minutes, one of the major target groups identified is women aged 55-64, many of whom work full or part time and want a functional lunch. One third of Zugo’s sales currently go to them, and there’s plenty of further potential.

GT – How are the Zugo’s Pasta Pots doing?

Pasta Pots are rolling out into the major multiples this autumn. They’re in 500 Co-op stores and doing well in the symbol groups. Zugo’s sits halfway between ready meals and snacks, and more product formats will follow. Pasta Pots need trialing to develop here: they’ve exploded on the Continent, with Monoprix listing five or six Pasta Pots and extensive own label, and Carrefour having a Pot meals bay.

Pasta Pots are rolling out into the major multiples this autumn. They’re in 500 Co-op stores and doing well in the symbol groups. Zugo’s sits halfway between ready meals and snacks, and more product formats will follow. Pasta Pots need trialing to develop here: they’ve exploded on the Continent, with Monoprix listing five or six Pasta Pots and extensive own label, and Carrefour having a Pot meals bay.

GT – Does your research show there are consumers who go shopping specifically for Rustlers, Zugo’s and Rustlers Hot Subs?

There are some hardened loyalists in grocery, but hot snacks aren’t as high on the shopping list as other foods. Visibility is key – we’re in a competitive set with the other ‘hunger relief’ products mums buy for their menfolk in the supermarket. In convenience format stores our products are more overtly seen as a ‘mission’ purchase, especially for single men refueling on Saturday morning or Saturday night! In microwavable snacks Rustlers is the brand that gets referenced most often.

GT – What is the availability of Rustlers and Zugo’s like? What kind of sales increases can people achieve by following your recommendations?

Availability in lunchtime/’food for now’ sections depends on how the particular store is structured. In convenience format stores in controlled estates, and in supermarket-sized stores, most retailers can expect to achieve 30% sales increases over three months by following our guidelines.

GT – Do you offer UK retailers trade education about merchandising, range stocking and so on online?

Yes we do. Retailers need to clarify the category in both grocery and convenience outlets, and put value high on the agenda. Next year we’re focusing more on product education – there’s sometimes a barrier to stocking if the buyer doesn’t understand the product to begin with! Once people taste them, they’re converted.

GT – If a store manager or buyer in a multiple grocery business – a supermarket, Co-op or c-store chain – is reading this and doesn’t currently stock any Kepak products, which ones would you advise them to stock?

They should stock the biggest sellers, starting with Rustlers Original Quarter Pounder, the BBQ Rib and Chicken Sandwich, Rustlers Southern Fried Sub and Zugo’s Chicken Mozzarella and Pesto, in that order. Larger stores should take the full range, up to 15 SKUs.

GT – How has the Singing Gondolier sampling campaign for Zugo’s gone down?

The Gondoliers went down very well as the creative face of the Zugo’s 2012 sampling. People remembered them, aided by our effective use of social media. Zugo’s have also been sponsors of ‘Friends’ on Comedy Central, which raised brand awareness from 10% ‘pre’ to 25% ‘post.’ The benefit of Friends was, it was a sledgehammer in terms of frequency, with brand idents running 20 times a day. We’re back on in September/October, with new idents to refresh the message.

GT – What about the Butchers Daughter campaign for Rustlers? What did that entail?

We put QR codes on 8 million packs, and sent out digital messages via social media, resulting in 7 million people watching videos on demand. Huge!

We put QR codes on 8 million packs, and sent out digital messages via social media, resulting in 7 million people watching videos on demand. Huge!

GT – Now here’s the really important question – any plans to do more promotion with Lexi O’Leary, star of Butcher’s Daughter?!

Yes, the good news for Lexi’s millions of fans is that the Butcher’s Daughter campaign will be ongoing. We can’t get the quality message across overnight, so we’ll be continuing it.

GT – Rustlers are now in their tenth year of TV advertising, so they must be appealing to a new generation of teenagers these days. How are you engaging with the original teenage Rustlers consumers, now in their mid to late 20s?

Our research shows we are definitely engaging with them. The percentage of 25-34 adult males eating Rustlers is growing consistently, and the brand profile is now broader, more like 16-34.

GT – Following on from that, are there any plans to link Rustlers with mid 20s males and above through their known interests such as sport?

The classic areas for marketing to male consumers are comedy, music and sport, but it’s hard to get cut-through because of noise from big brands with huge budgets, hence for now we’re focusing heavily on gaming and the digital world, areas we have made our own.

GT – What other promotions have you got coming up?

We’ve got two partnerships lined up with Rustlers – an on-pack promotion and competition linked to the new adult comedy film ‘Ted,’ and a link for the games release in November of ‘Hitman: Absolution.’ As the major multiples take a bigger share of UK game sales, we’re having advance conversations about on-pack tie-ins with their planned in-store gaming activity.

GT – You’ve built your convenience foods business based on a stream of NPD that makes other major FMCG players look sleepy by comparison. Can you hint at what’s next in terms of NPD, and what forms will it take?

This year we concentrated on value with Rustlers – next year will be more about breaking through beyond ‘meat in a bun,’ looking at such opportunities as pot meals, big night in occasions and more snack-oriented products. Zugo’s activity in the pipeline includes wraps and launches for over 55 women, converting our consumer insights into brand implementation

GT – We’ve been focusing on the UK in this interview, but how are your plans for continued expansion in Europe progressing?

Rustlers are a big success in Germany, going from a presence in 300 Rewe stores in the West of the country to stocking in 1,200 stores nationwide. France is still largely at test stage; in Belgium we’ve doubled our sales in the last 18 months and are now number 1 in Carrefour; and in Holland we’re still number 1, growing more than 30 percent annually.

GT – What do you see as the major challenges and opportunities for 2013?

In the UK we’re still nowhere near the distribution level we’d like to be at either on the convenience side or in the multiples, and there are big wins to be had. We have some exciting NPD coming through, which will help.

GT – You’ve talked before about your growth strategy focusing on the three ‘I’s, investment in sustained brand support, insights into the dynamics of shopper behaviour and innovation in terms of flow of NPD. What are your plans from here on in?

We’ve talked already about our NPD pipeline; we expect our overall investment in brand support to continue at an increased level. We have a number of ‘insight’ projects in hand, including the work we talked about earlier with 55-plus women and 25-plus men. Staying with our growth strategy, in terms of the different UK regions we’re significantly under-indexed in London, and increasing distribution in convenience stores and independents could add an extra 5% to our total sales.

We’ve talked already about our NPD pipeline; we expect our overall investment in brand support to continue at an increased level. We have a number of ‘insight’ projects in hand, including the work we talked about earlier with 55-plus women and 25-plus men. Staying with our growth strategy, in terms of the different UK regions we’re significantly under-indexed in London, and increasing distribution in convenience stores and independents could add an extra 5% to our total sales.

GT – Finally, you also talked before about doubling your convenience foods business over the next five years. How is that plan coming together?

I’m pleased to say we’re ahead of schedule – in 2011, we were around £70m in the UK retail sector, and now we’re up to £110m in just 18 months. Our convenience sector business has also grown 30% since 2009, and there’s good news too from Europe, as I said earlier. So on that basis the target of going from £70m to £140m is well within our grasp – and not many businesses can confidently say that in the present climate.

Kepak Convenience Foods

Tel: 01772 688 300

Comments are closed.