The total hot beverages category is up 9.5% YTD (Nielsen) and this is fuelled by the growth of coffee. The increase of sales from the coffee category provides 76% of the overall growth of hot beverages (Nielsen), as consumers continue to bring their out of home coffee occasions in-home. Double digit growth is expected to continue as more consumers explore the coffee shop experiences available to be enjoyed at home.

Contributing 62.5% of value sales within the total coffee category, core instant coffee increasingly shows strong growth in retail, and remains an important category within coffee (Nielsen). This can be seen within the Kenco Core range which is now worth over £65m and is enjoyed by over 4 million households in the UK (Nielsen).

Contributing 62.5% of value sales within the total coffee category, core instant coffee increasingly shows strong growth in retail, and remains an important category within coffee (Nielsen). This can be seen within the Kenco Core range which is now worth over £65m and is enjoyed by over 4 million households in the UK (Nielsen).

“Many of the coffee trends in retail have been driven by demand in Out of Home coffee consumption, as stay-at-home consumers look to recreate their daily coffee habits,” comments Michael Haynes, Category Team Leader, Jacobs Douwe Egberts. “This has led to a rise in quick and convenient formats that deliver speciality, coffee shop tastes. Coffee is a key part of many regular consumer journeys and, as commuting significantly reduced since the spring due to the impact of COVID-19, in home coffee consumption is accelerating.”

Consumers’ desire for coffee-shop style drinks is driving value sales growth of specialty coffee such as Latte and Cappuccino. Kenco specialities have particularly benefited from this trend and have seen value sales growth of +5.9% in the MAT (Nielsen). With Latte being the most popular coffee style for the morning (42.9%), followed by Cappuccino (19%), and Americano (16.2%), stocking a diverse selection of coffee products and flavours is key to meeting a variety of consumer hot beverage demands.

There has been a strong rise in single serve coffee showing +14% value sales growth in the MAT, reaching 17% share of total coffee sales (Nielsen) , this is subsequently driving the trend of premiumisation within the coffee category with consumers looking for a higher quality experience.

Enjoyed by over 2.4 million households in the UK (Kantar), Tassimo prepares every drink individually at the touch of a button. This makes it perfect for coffee consumers looking to replicate the out of home experience and achieve the quality of a barista beverage with instant ease. With value sales of over £97m and over 55% share of the single serve market within retail (Nielsen), it’s clear that this consumer trend is still influencing the retail market.

Nespresso Compatible Capsules also continue to drive growth of the single serve market, with the segment seeing strong double-digit value sales growth year on year and a +6pt growth in share in the MAT (Nielsen). L’OR Capsules remain the number one brand within the retail grocery market, with 32.2% share of the segment and value sales of over £16m in the MAT (Nielsen).

The launch of Kenco Duo has also brought coffee shop trends direct to the consumer at home with no need for a machine and has achieved sales of just over £3.9m since the launch in September 2019 (Nielsen). Creating a new segment within the coffee category, Kenco Duo comprises two quality ingredients in a fully recyclable pot enabling consumers to craft their chosen beverage easily and without expensive machinery. With consumers becoming increasingly more health conscious, and following the success of Duo in 2019, Kenco has launched its Unsweetened range, offering a low-calorie option for those looking for healthy alternatives whilst still enjoying great tasting coffee.

Out of home, seasonal beverage lines have become staples for branded operators, with 23% of coffee shops believing them to be among the fastest growing beverages in the UK (Allegra).

Designed to capitalise on the gingerbread flavour trend which performs exceptionally well during the festive period, Tassimo will be adding Costa Gingerbread Latte to its seasonal line-up. When previously available, Tassimo Costa Gingerbread Latte has been purchased by over 380k households in the UK delivering just over £1m worth of value sales in the Grocery channel (Nielsen).

Parminder Walia, Category Development Manager for Tetley, comments: “Recent months have been challenging for retailers and suppliers alike. Within the retail environment and wholesale, a surge in shopping for essential items in March and April resulted in many no or low stocks, which in places, have yet to recover to normal levels.”

Parminder Walia, Category Development Manager for Tetley, comments: “Recent months have been challenging for retailers and suppliers alike. Within the retail environment and wholesale, a surge in shopping for essential items in March and April resulted in many no or low stocks, which in places, have yet to recover to normal levels.”

Within wider grocery, tea sales in the 4 weeks to 21.3.20 rose by 40.8% with sales boosted across all tea segments; hot favourites were everyday black teas, up 40.1%, everyday decaf, up 52.1%, and speciality teas up 43.9%.

After the initial rush to stock up, sales are settling down to normal patterns. In the grocery multiples overall tea sales rose 7% in the 4 weeks to 11.7.20, with volume sales of black tea up 7.6%, fruit & herbal 5%, decaf 13.4%, green 3.3% and redbush up 10.6%.

There are a number of reasons that tea sales have remained buoyant.

“Whilst the initial surge was to ensure cupboards remained full, its popularity as a drink owes its good fit with the quest for healthier lifestyles,” adds Walia. “As a beverage it is sourced from natural ingredients, contributes to daily fluid intake; and helps give structure to the day providing an opportunity to take time out, whether for ourselves, or to catch up with others.”

Kantar figures show that the numbers buying tea and the spend per buyer have all increased. Among the tea brands Tetley has maintained its record of having the largest number of buyers and the greatest household penetration. Kantar usage also shows the number of tea occasions at home and carry out to have grown 785m yoy.

With different teas now available to suit every taste and occasion, the mix of teas stocked is important. To complement the big sellers of everyday black, a carefully selected range of green and fruit and herbal teas, plus an essential decaf are a good starting point to cater to different tastes and needs.

With heightened focus on health, products like decaf and functional food and drinks with added vitamins are proving popular. Volume sales of Tetley decaf have grown 13.4% in the 4 weeks to 11.7.20 in the multiples and by 34.6% within impulse.

Fruit and herbal teas are particularly popular among 18-24s with 39% regularly choosing herbal tea and 26% a fruity brew.

In June, Tetley introduced a new range of Tetley Herbals to its line-up of teas. Available in 6 trending flavours they are what Tetley terms ‘classic gateway herbals’. “Shoppers often view herbals as either classic herbals or advanced, with exotic sounding ingredients that many may not have heard of before,” says Walia. The new range of Tetley Herbals offers simpler, natural ingredients which provide a safe and familiar pathway for habitual black tea drinkers to enter the herbal space.”

As one of the newer entrants to the fruit and herbal sector, Tetley Herbals will supplement its more premium functional range of Super teas with added vitamins. The new packs of 20 Tetley herbals were launched at the end of June with an RSP of £1.49 and are available to all retail channels.

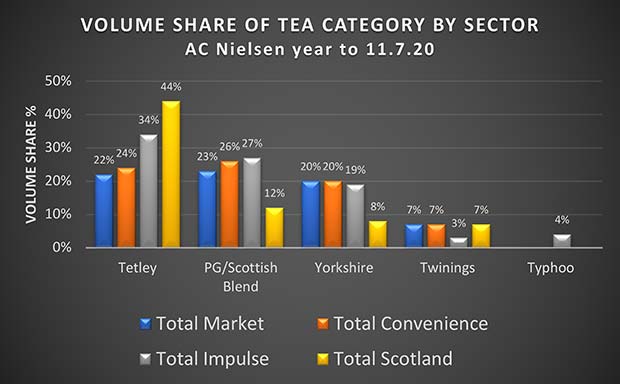

“Although in the absence of their normal choice of brands shoppers have increasingly trialled non branded products, when it comes to tea shoppers like known brands,” Walia suggests. “It’s important to take note of the top sellers and ensure their availability is clear to see and of regional differences, so that the big sellers are given prominence in the mix and different types of tea are displayed in a logical order.”

During lockdown, all categories of tea showed strong growth, as things ease decaf, fruit and herbals and redbush teas remain strong sellers.

“Whatever the mix of tea stocked, thought needs to be given to how to bring attention to the different products available and what they offer,” Walia continues. “Not doing so risks many high value products going unnoticed because of poor layout, or lack of education and focus at fixture.”

“To help maximise sales think of how your mix of teas can fit with different tea occasions,” Walia suggests. “Themes like breakfast; mid-morning power boost; lunch time cleanse; tea time bake off treat; healthy lifestyle; or wind down me time can all be supported easily, and products associated with them grouped together to maximise appeal. With the right mix of products and focus on tea occasions retailers can extend the window for product sales beyond the traditional breakfast cuppa or tea time break, benefitting sales across several categories.”

As shoppers continue to shop more locally the offer of value will be increasingly important to maintain customer loyalty.

“Recognising the value of price mark packs in reassuring customers of value is important here,” says Walia.

Price mark packs and packs with extra free will grow in importance in the battle for customer retention, 82% of shoppers actively seek them out when shopping (Him!).

“Think carefully about where best to use price marked packs, they are most important in useful high-volume segments like every day teas and decaf where they work well to boost volume sales, but whilst lower prices encourage shoppers to buy more and stock up, they do little for profits,” Walia adds. “It comes down to getting the balance right between offering the right price mark to encourage higher volume sales of essential everyday products, whilst leaving space for higher value products like fruit and herbals and green, which don’t necessarily need to be sold as a price mark and can deliver higher margin sales.”

Sales patterns show that there are strong opportunities in tea. The challenge is to keep pace with changing tastes and what drives purchase and use this knowledge to adapt your tea range. Getting it right can result in greater sales and profits in tea and benefit sales in other categories too.

With over 100 years’ experience in tea development, Typhoo is one of the nation’s top tea brands and an established household favourite with 1 in 4 cups of tea bought in retail made by Typhoo Tea Ltd (Kantar). “Black tea is a staple of British life and is currently enjoying a resurgence in popularity with sales up 12.8% vs 9.6% for the wider hot beverages category,” says Des Kingsley, CEO of Typhoo Tea Ltd.

“With people spending more time at home due to Covid-19, millions of consumers have rediscovered their love of a traditional cuppa and we’ve been working hard to ensure enough product is available to meet the surge in demand.

“As one of Britain’s best loved brands, Typhoo Tea has built a reputation over the years as a trusted household name, maintaining high brand visibility and providing the best quality for the best value.

“We have a solid base of consumers already buying into the brand. The next stage in Typhoo’s journey is to re-engage shoppers using a campaign that reinvigorates our bold personality, which was historically always laden with British humour and satire. The plans we are putting in place will not only keep those consumers buying more but will bring new shoppers into both the brand and the hot beverages category.”

The range comprises variants to suit all customers with a range of pack sizes to suit all retail outlets. Typhoo uses not only the best ingredients in association with Rainforest Alliance using tea from Rainforest Alliance Certified farms that have environmentally and socially responsible practices.

Bryan Martins, marketing and category director, Wessanen UK, comments: “The wellbeing trend has been around for a while, but now more than ever, people are realising the importance of looking after their physical and mental health. Tea is often associated with having a moment to rest and take a break, which is good for our mental health. Though there is also growing demand for teas that can offer an additional health boost from improved sleep or help with digestion or inflammation. Shoppers, for example, are also buying products with antioxidant properties such as tea infusions containing turmeric or hemp.”

During lockdown, value sales of Clipper Everyday Tea grew by +35% (IRI, 12we June 20 vs 19) and Clipper continues to be the fastest growing black tea in the market. Shoppers are favouring tea that tastes great, comes in a wide variety of pack sizes for different usage occasions and is also biodegradable and environmentally friendly. The growth of the conscious shopper remains prominent in the tea category and is driving consumer decisions.

Clipper remains the fastest growing black tea and is attracting a younger, more conscious consumer to the category. The biggest draw for Clipper drinkers is the brand’s commitment to making natural, fair and delicious tea. One of the founding Fairtrade brands, Clipper is the UK’s largest Fairtrade tea brand with a long-standing commitment to organic and natural sourcing. Sustainable tea is expected to deliver 75% of the category growth over the next few years.

“A strong focus for Clipper this year will be to support retailers in choosing a core range of teas that we know can help them to build incremental sales,” adds Martins. “There is huge potential to be unlocked with teas that tick all the boxes for consumers right now – a great tasting cuppa with a clear conscience can go a long way.”

Retail sales of Roast & Ground coffees are rocketing by +9.2% (value) year-on-year (Nielsen) as discerning shoppers are looking to replicate their coffee shop experience at home, a trend that has naturally accelerated during the current period when people have been unable to get their favourite serves out of home.

Lesley Parker, Brand Controller for Cafédirect at distributor RH Amar, comments: “Adding to this trend, Cafédirect’s commitment to invest 50% of all profits into Producers Direct – a UK charity that works directly with farmers to improve sustainability and livelihoods, right across the coffee growing world – is resonating more strongly than ever with shoppers, who have an even keener sense of supporting brands that have a strong quality and ethical sourcing credentials.”

As a result, retail sales of Cafédirect products are even outpacing the fast-growing Roast & Ground category, with value sales up by +23.3% in the last year.

Cafédirect’s new Single Origins Mayan Gold offering from Mexico (RRP: £4.50, 227g) – offers an opportunity to experiment with different flavours from around the world, whilst supporting growers directly in the process. Mars Chocolate Drinks & Treats [MCD&T] has announced the redesign of its Maltesers Hot Chocolate products.

Available in a 350g or 180g jar, 140g pouch, 25g single serve stick and hot chocolate pods, Maltesers® Hot Chocolate boasts a super chocolatey taste with a hint of malt.

The UK hot chocolate category has an annual sales value of £126 million (Kantar) with brands continuing to dominate. Branded value sales now account for a huge 84% or £106 million (Kantar).

Galaxy and Maltesers hot chocolate are popular choices with consumers, with one in eight UK households buying one of these branded hot chocolate products last year (Kantar).

Michelle Frost, general manager at Mars Chocolate Drinks & Treats, says: “We are delighted to share our new look Maltesers Hot Chocolate with retailers and consumers alike! The eye-catching packaging really brings to life the chocolate taste of this delicious drink, and creates synergy on-shelf with our Galaxy Hot Chocolate range.”

Vimto has launched a limited-edition cordial in time for the colder months: Winter Warmer, available nationwide from October in 725ml bottles.

With the recipe specifically developed to be enjoyed hot, Limited-Edition Winter Warmer takes the much-loved, unique blend of Vimto No Added Sugar squash and infuses it with cinnamon, nutmeg, and clove to offer a festive flavour.

Just like all Vimto squash flavour extensions, Winter Warmer is perfect for families thanks to its real fruit content, no added sugar and added vitamin C.

Now the number two squash brand, Vimto is continuing to go from strength to strength, reaching a record high brand value of £93.6million (Nielsen). Constantly recruiting new households, brand penetration has also reached 25.4%, with 7.1million buyers across the UK (Kantar).

Becky Unwin, Senior Brand Manager, Vimto, said: “When the evenings get darker and there’s a chill in the air, we know that our consumers will reach for a steaming mug of Vimto to warm themselves up”

“This year, we’re excited to build on the love for Hot Vimto with Winter Warmer – a brand new, seasonal flavour that tastes amazing heated up thanks to its spicy notes. We’re confident it’s going to be a best-seller.” Vimto Limited-Edition Winter Warmer will be available in stores nationwide until January.

Comments are closed.