At £3.6 billion, whisky is worth more than any other spirits market in the UK. However, the continued decline of blended whisky, which accounts for 72% of the category’s volume sales, means that in the next five years it will see an 11% decline in real value sales.

At £3.6 billion, whisky is worth more than any other spirits market in the UK. However, the continued decline of blended whisky, which accounts for 72% of the category’s volume sales, means that in the next five years it will see an 11% decline in real value sales.

While the total whisky market is worth £3.6billion, in reality it is three markets rather than one with each distinct segment attracting a different type of drinker.

Imported whisky (mostly Bourbon/ Tennessee) will be the main driver of growth (up 12%) over the next five years benefiting from its appeal to young drinkers. Heavy brand investment from the likes of Jack Daniel’s has helped demystify the drink and promote its consumption with a mixer.

Malt whisky has great potential, but will see slower growth (4%) in volume sales over the next five years. Viewed by consumers as better quality, malt is also seen as more intimidating, and this combined with being a fragmented market has led to confusion among consumers and a failure to attract 35-54 year-olds looking for a more aspirational choice and sophisticated taste.

Blended whisky represents almost three quarters of the market but has been in long-term decline in the UK, fuelled by increasing commoditisation in the off-trade. This is in stark contrast to emerging global markets where blended brands such as Johnnie Walker are seen as highly aspirational.

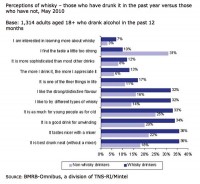

One of the primary problems for the whisky category as a whole is that it attracts an ageing demographic and needs to renew itself among today’s generation of drinkers. While bourbon/Tennessee whiskies have done an excellent job bringing 18-34-year-olds into the category, this is not necessarily the best route for malt and blended brands to go down.

Mintel’s analysis shows that 18-34s are worth less in value to the alcohol industry than older consumers and they also tend to be more brand-fickle and have a less developed palate, while being the most heavily targeted by alcohol brands. Therefore, it makes sense to target people as they reach their mid-thirties and are more ready to embrace a premium but strong-tasting and sophisticated drink alternative.

Mintel’s research shows that whisky is currently not appealing enough to 35-54-year-olds, especially the larger base of aspirational individuals, who are still adventurous in trying new drinks and more likely to have greater disposable income to spend on malt and deluxe whisky brands

With four fifths of volume sales taking place in the off-trade, the whisky category is in a precarious position in terms of brand building and balancing the power of the major multiples.

High-quality malt and deluxe whiskies in general struggle to gain access to pubs which remain dominated by blended whiskies, and increasingly by US bourbon.

Whisky is a hugely important category for supermarkets particularly from September until the end of the year.

Yearly whisky sales are especially strong from September until the end of the year, with sales peaking in December. They then drop off between January and March but Easter and Father’s Day are key promotional occasions.

Comments are closed.