While the UK’s love affair with a tanned appearance continues, with nearly half of consumers believing that a light tan makes them look better and healthier, educational campaigns warning of the risks of sun exposure are having an effect.

While the UK’s love affair with a tanned appearance continues, with nearly half of consumers believing that a light tan makes them look better and healthier, educational campaigns warning of the risks of sun exposure are having an effect.

Interestingly, while consumers have cut back on expenditure in many areas, including overseas holidays, suncare sales have risen an estimated 4% in 2010, hitting a total of £284 million. However, not all suncare categories benefited equally. Consumers are unwilling to compromise on safety and continue to invest in sun protection, which grew 6%. Sales of aftersun, which is perceived as a more discretionary purchase, have fallen 3%. Self-tan products, which are being squeezed by gradual tanning body lotions (not included within the scope of this report) managed to hold steady.

Although sales of lotions and milks have continued to grow, the format has been pushed into the background by the newer spray format. Sprays have increased their market share as they are more popular with men and children, and thanks to improvements in formulation, which has allowed sprays to match lotions and creams in terms of SPF and UVA/UVB ratings. Creams are regarded as rather old fashioned and heavy, and have fallen out of favour compared to lighter, more easy to apply formats. Oils, on the other hand, may be largely associated with traditional, low SPF products, but the format has been updated with lighter textures and higher SPFs. This is set to increase oil’s market share by the end of 2010.

Britons are still in love with tanning – four in ten adults, rising to half of women, think they look better and healthier with a light tan. But the suncare industry still has a lot of work to do as just half of women and four in ten men use sun protection. As many as three in ten under-25s don’t bother using sunscreen in the UK (8 percentage points above average), and consequently 32% have been sunburnt in the last 12 months.

Nearly one half of men admit to rarely using sunscreen, with 28% only using sunscreen when abroad (compared to only 16% of women). Suncare brands need to address the disparity between women and men’s knowledge and use of sunscreen and attract men via in-store promotional campaigns to raise awareness; product innovation to simplify the process of applying and keeping track of when to re-apply; and interactive strategies that provide guidance and keep the customer engaged with the product.

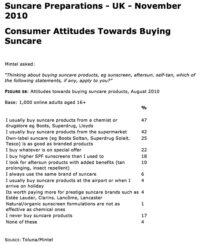

Convenience is everything when it comes to suncare purchases. Boots is the largest retailer, as many consumers trust it as both a retailer and a brand owner, while multiple grocers capture more than a fifth of sales thanks to consumers adding suncare products to their shopping trolleys.Four in ten consumers buy suncare before going on holiday abroad – but only 4% buy it at the airport.

Nearly one in five consumers deem suncare too expensive, which helps explain the fact that the average consumer uses less than one bottle every summer.

Comments are closed.