Worth £721 million in 2008, the pizza market is set to continue to grow by over 5% in 2009, with frozen pizza being slightly more important than chilled. Many consumers are trading around in pizza due to the recession, going from restaurants to takeaways or from takeaways to chilled or frozen pizzas, presenting opportunities to manufacturers.

Worth £721 million in 2008, the pizza market is set to continue to grow by over 5% in 2009, with frozen pizza being slightly more important than chilled. Many consumers are trading around in pizza due to the recession, going from restaurants to takeaways or from takeaways to chilled or frozen pizzas, presenting opportunities to manufacturers.

Longer term, retail sales for pizza are forecast to reach £883 million by 2014, an increase of 16% or over 5% in real value terms.

Between 2004 and 2009, the market for pizza grew by an estimated 19%, with most of the growth experienced since 2006. In real value terms, however, the market has been fairly stable, being only slightly behind inflation. Pizza is a very promotion-driven market in which it is not always easy for manufacturers to raise prices, limiting value growth. In fact, four in ten adults buy pizza because it is not too expensive.

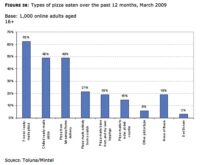

The pizza market has been shared almost equally between frozen and chilled over the last five years, despite frozen pizza having the larger consumer base (47% of adults eat frozen pizza, compared to 36% who eat chilled), which is a reflection of the generally higher prices in the latter sector.

In 2007, value sales of chilled pizza slightly surpassed those of frozen pizza, but thanks to a revival in the freezer aisle, frozen pizza was again on top in 2008 – again with a modest margin – and is set to continue to be so in 2009. Pizza bases and sauces have only a very small share of the market, estimated at a retail sales value of £10 million in 2009.

Chilled pizzas are almost exclusively purchased from supermarkets, largely thanks to the dominance of own-label in this sector. Smaller outlets find it more difficult to stock chilled pizza, due to the shorter shelf-life and the space needed for the refrigeration equipment. Frozen pizzas, on the other hand, are also found in freezer centres, although the bulk of sales (80%) also goes through multiple grocers.

Around seven in ten adults eat pizza, with families being among the most enthusiastic, although half of adults who eat pizza only do so once a month at most. Many adults appreciate the convenience of pizza and mainly buy it to please their children. Family packs that cater for both adult and children’s tastes could help more people to appreciate pizza as more than a quick meal fix.

Families in the C1 social grade, who are keen on all types of pizza, have become more thrifty shoppers in the recession and will most likely look out for promotions in pizza in the future. Meanwhile, the more affluent ABs enjoy making pizza from scratch, reflecting their interest in cooking from scratch. Making pizza from scratch is also a good way to make it healthier as well as to save money. Over a third of adults (35%) do not really eat pizza and are not interested in the category. They tend to be men, aged over 45 and from DE socio-economic groups.

In terms of innovation, pizza kits offer a great opportunity to tap into consumers’ growing interest in cooking from scratch. Manufacturers have developed products with fewer additives and healthier recipes, as more consumers are paying attention to product ingredients. As the market for frozen foods hots up six in ten new pizza launches were launched in the frozen aisle in 2008.

Comments are closed.