Consumers’ eating habits are in constant flux. Much like fashion, grocery shopping trends can regularly change and evolve and so brands and retailers are under a lot of pressure to respond to consumer behaviour shifts and develop products that suit, says Katrina Bishop, Thought Leadership Activation Manager at NielsenIQ. This is also a challenge because these trends also vary across markets, and so brands and retailers need to ensure they are on the front foot of behaviour changes and address this in their product portfolios and assortments.

NielsenIQ’s latest survey* on ‘Conscious Eaters’ examines five European key markets (UK, France, Germany, Italy and Spain) and reveals one trend that all shoppers have in common. This is the desire for a balanced diet, which focuses on increasing the intake of more fresh products. On average, high quality and regional products are now seen as a priority for consumers following a healthy diet across Europe.

NielsenIQ’s latest survey* on ‘Conscious Eaters’ examines five European key markets (UK, France, Germany, Italy and Spain) and reveals one trend that all shoppers have in common. This is the desire for a balanced diet, which focuses on increasing the intake of more fresh products. On average, high quality and regional products are now seen as a priority for consumers following a healthy diet across Europe.

However, perceptions of what is a healthy diet differ from one country to the other. Cultural habits and different lifestyles weigh in on the act of purchase, such as different cultural beliefs and customs, and can impact the motivation for leading a healthy diet. Only 16% of UK shoppers believe that having a healthy diet is achieved through consuming organic products, but this belief is far more important for Spanish consumers (32%).

The new UK consumers: what does healthy mean to them?

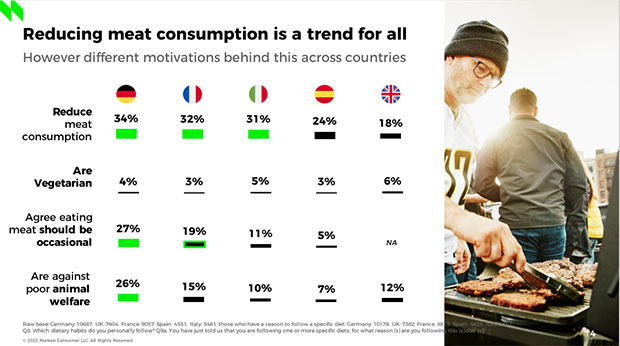

Ensuring you are responding to new trends is imperative to attract new customers and retain them. According to data from NielsenIQ, Brits have been championing vegan (3%) and vegetarian (6%) diets more than any other European market. Brands have responded to this by revising their product assortments. For ‘Veganuary’ this year, where consumers are more likely to test out the vegan diet, Magnum launched its new Magnum Vegan Mini Classic and Almond ice creams, while cheese brand Babybel launched its plant-based version.

With such heavy competition among British supermarkets and the continued rise of the discounters – which can have an extra sway with customers by undercutting on price – retailers should focus on ways they can differentiate their offerings such as via exclusive product ranges and developing private label options that can tap into existing trends.

Out of all the countries surveyed, UK consumers are more likely to want to feel in control over what they eat (31%). With this in mind, brands must make every effort to inform consumers about their product, from its origin to its nutritional value. The Nutri-Score label, easily informs consumers of the nutritional value via its colour rating system. Moreover, John West includes on its packaging ‘trace your plate’ allowing customers to find out more about the quality of their fish and where it has come from, thereby giving customers further control and information on what they are consuming.

For Brits, taste (94%) is the most important deciding factor when making a grocery purchase. This was closely followed by freshness (92%) and quality (90%). With this in mind, brands should take into account this preference when formulating new products as well as take extra care in addressing this priority in any diet ranges or alternative choices which may traditionally compromise on taste. Brands that master this can increase the chances of building their customer base and in turn create a differentiated proposition in the market.

What is ahead for UK grocery retailers?

Food retailers and brands must expand and adapt their offerings, using actionable insights to help inform and develop product ranges to cater to changes in consumer eating habits.

Brands should always keep a finger on the pulse of consumers’ preferences and needs when it comes to their dietary habits, as they can change quickly. For instance, leading US brand Beyond Meat and Canadian Maple Leaf Food, which specialised in plant-based food recently experienced a slowdown in growth in the US as it was perceived as an ‘expensive novelty’ without adding further value to the consumer.

With UK inflation increasing to 5.5% – the highest in nearly three decades – British consumers will be concerned over the rising cost of living. According to NielsenIQ data, 85% of consumers state that price is an important factor when buying food and drinks. While price may not yet be as popular a deciding factor as taste, freshness and quality, clearly it is still an important consideration for UK shoppers, and may even surpass them over time. This may lead to another shift in consumer dietary trends as shoppers will be driven more by price than ever before. Retailers and brands are therefore urged to adapt quickly to these changes if they want to stay ahead.

Comments are closed.