A sense of optimism has returned to the British dairy industry in 2010, with farmers and processors investing in expansion and forming producer group alliances with retailers.

A sense of optimism has returned to the British dairy industry in 2010, with farmers and processors investing in expansion and forming producer group alliances with retailers.

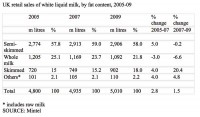

Over the last 5 years and despite a global recession, sales of both milk and cream performed well with an increase of 5.6% in volume and an impressive 15% in value to an estimated 5,249 million litres valued at over £3.4 billion in 2010.

Within the general dairy market, flavoured milk is currently the most buoyant sub-category whilst allergy-friendly substitutes and specialist lines are driving growth in the cream market.

The once stagnant category of flavoured milk drinks has undergone a revival, with volume and value climbing to an estimated 125 million litres, worth £160 million in 2010. In particular, the past few years have seen the chocolate variants leading the market, as consumers turn to life’s little luxuries to stave off recession depression.

Within the fresh white milk segment, skimmed and 1% milk have performed strongly as consumers have taken on advice from the FSA’s campaign and switched from whole milk to skimmed and other milks for health reasons.

The organic milk sales have also held up well in the recession, with continued growth in 2008 and 2009. However, the category is facing increasing competition from non-dairy alternatives. In fact, rice, nut, grain and seed-based milk substitutes have increased threefold over 2008 to 2009 offering further alternatives to customers with lactose intolerance.

Cream is also posting strong volume and particularly value growth. Rising dairy prices, together with growth in niche, premium sub-categories have boosted the fortunes of the cream category across volume and value growth.

The greatest value growth is notable in the sour cream category/segment, which has seen retail sales going up by 60% between 2007 and 2009.

Mintel research shows how today just over a fifth (21%) of Brits reject the taste of standalone milk, whilst a quarter (25%) believe they should drink more milk but probably don’t because it doesn’t spring to mind as a drink choice.

The future opportunities for the dairy industry to secure continued growth rely in the capacity to re-engage with its audience, reasserting its role as a healthy drink for adults and children alike. In particular, the industry needs to convey milk’s continuing relevance in light of ongoing innovations occurring in other markets. Eco concerns aside, in fact, many of the challenges the industry currently faces can be attributed to increased competition from other beverage categories and to the FSA and government healthy eating campaigns against saturated fat, which have arguably had a knock-on effect on consumption of milk overall.

Milk, in other words, needs to update its image making its naturally occurring functional components its core strength and develop more niche, uber-functional lines comparable to those in the weight loss and energy drinks market.

Comments are closed.