The year 2020 may have been a tough year for many people but at least Christmas is on the horizon. That occasion will give consumers the chance to buy boxed chocolate and other confectionery items as an affordable gift or a treat for themselves. Levi Boorer, Customer Development Director at Ferrero, tells Grocery Trader how retailers can merchandise the confectionery fixture to prepare for the season.

In this year of Covid-19, when there has been so much uncertainty, how do you anticipate the Christmas confectionery market will perform?

In this year of Covid-19, when there has been so much uncertainty, how do you anticipate the Christmas confectionery market will perform?

We are looking at the market with a sense of optimism. We have got strong reasons to be happy that things are going to improve. In order to understand how the market is going to perform, it is probably worth taking a step back and looking at last year. Last year the market was up 0.2%. It was a dreadful year for retailers because there wasn’t a lot of growth going on. That was on the back of the Brexit situation swirling around, the general election, people being quite divided in their opinions about who they were going to vote for.

Whilst shoppers were making fewer trips in the last two weeks of December, Monday 23rd and Saturday 21st were the biggest shopping days, with 66% of the population shopping on ‘Manic Monday’ and £1.4bn going through the Grocers’ tills across the two days. That’s £45m more than the two biggest days in 2018 (+3.2% YoY according to Kantar). Supermarket sales grew marginally by 0.2% in the 12 weeks to 29th December – however this was the slowest rate of growth since 2015 (Kantar).

People were opting for smaller, more functional Christmas occasions in 2019 – there were 168m fewer occasions featuring five or more people. Throughout November, large occasions accounted for 7% of all occasions, down from 10% in 2018 (Kantar). Online also grew exponentially last Christmas, at 12.8% in December alone and against growth of 5.8% in the same period in 2018 (Nielsen).

Kantar data revealed that people celebrated Christmas on their own, rather than together. That was reflected very much in the types of Christmas people had. There wasn’t a lot of splashing out, there wasn’t a lot of enjoyment last Christmas.

Fast forward a year and it has been a horrendous year for many reasons. There has been a lot of people that have been negatively impacted by Covid. My heart goes out to people in other industries that are facing much bigger battles than I am. With confectionery we are very lucky. We are in a category that is affordable for most people and it is resilient. I have been at Ferrero 17 years and have always found booms and busts during that time. We have always found that no matter how bad the world outside the confectionery market is, it tends to see growth and there are always opportunities.

So the market will see some growth and that growth will come from people being slightly more relaxed than they have been about spending time together, slightly more nervous about spending time out of home. The out of home situation provides an opportunity to host more people and to spend more time together.

How far in advance of Christmas should retailers be planning their seasonal displays?

People are starting to think about the Christmas event at the beginning of September. In early September I saw twistwraps out at the front of store in a couple of retailers. Retailers are kickstarting the event and getting people back into Christmas shopping mode. As depressing as we all find it, that’s the reality. When people finish their summer holidays people start planning for Christmas. I think this year people will be slightly more keen to get together at home and enjoy time together. For that reason we are looking at a bigger market performance for confectionery than last year when times were less sociable.

Should the seasonal display be varied in the months leading up to Christmas – e.g. selection boxes in October, advent calendars in November, etc?

It’s vital for retailers to focus heavily on their product phasing. For confectionery, the September through to early October period is a vital ‘Early Bird’ period; it’s used to let shoppers know that ‘Christmas is coming’. The segments of focus are usually Sharing, Main Gift (smaller packs) and Self Treat.

Next up is the ‘Build Up’ phase – throughout mid-October to the end of November – a period that is worth £227m, so it’s crucial to the trade. This is when shoppers will start to purchase in earnest. The segments of focus are: Stocking Fillers and Advent Calendars, Main Gifts and Sharing.

Finally, as we enter December, we’re in the ‘Main Event’ phase – the final push that is worth £270m. Much like previous years, the final four weeks in December 2019 were key with 46% of confectionery sales going through in that period . Shoppers typically behave quite differently during this period, with an air of ‘panic mode’. Segments of focus are: Main Gift, Sharing and Stocking Fillers.

Do you have any other seasonal merchandising advice for retailers?

Do you have any other seasonal merchandising advice for retailers?

It’s not for us as company to tell retailers any more than they already know about their shoppers. If you are in a small community of people that celebrates Diwali, then clearly Diwali is a great opportunity for you to merchandise your product in the right way at the right time so that people can celebrate. There are so many mini-festivals throughout the event that you will know as a retailer how those events happen. So if you have lots of young kids in the area they will want to celebrate Halloween and their parents are looking to pop in and pick up a few items for trick or treat. You will react to that. There is an opportunity there. How big that opportunity is depends on the retailer, where their shop is and whether they celebrate the festival themselves. Historically we have provided support with promotions.

The different sub-seasons within the overall Christmas opportunity have to be planned and come December it is really important to give it a final push, getting behind the manufacturers’ promotional activity. Promotional activity has a role to play in September as well as it gives people an early bird taste of the products that are coming in for the season. We recommend promoting a range of boxed chocolates around September. With Diwali happening in October that is great for small shops. Then there is a great opportunity to make the most of the season around December.

Once Diwali and Halloween have passed, we would encourage retailers to promote a range of advent calendars. Smaller retailers can always get bitten by having too many seasonal products and then ending up having to discount them to get rid of them. So we want retailers to focus on stocking the best sellers rather than stocking every single product from the wholesaler. If retailers overstock, they will lose money. November is also important because it drives those stocking fillers. What the last few months has taught us is that small stores are massively important. If those small stores can offer solutions to Christmas, Diwali and all the mini-festivals, I think they can really give shoppers confidence that they don’t need to go to the bigger stores to find solutions to the Christmas occasion.

Which sub-sectors of Christmas confectionery (eg boxed chocolate, self-treat) showed the strongest growth last year?

Confectionery represents a category that has something many others are not as fortunate on: resilience. December 2019 itself was particularly strong, seeing growth at 5.5% (Nielsen). The Main Gift confectionery purchase was the beacon of light during a tough market in 2019, and Self Treat in impulse saw solid growth of +2.8% (IRI). The success of the Main Gift purchase was down to existing shoppers making more trips than the previous year; and again, those trips in general were being made online rather than in physical stores.

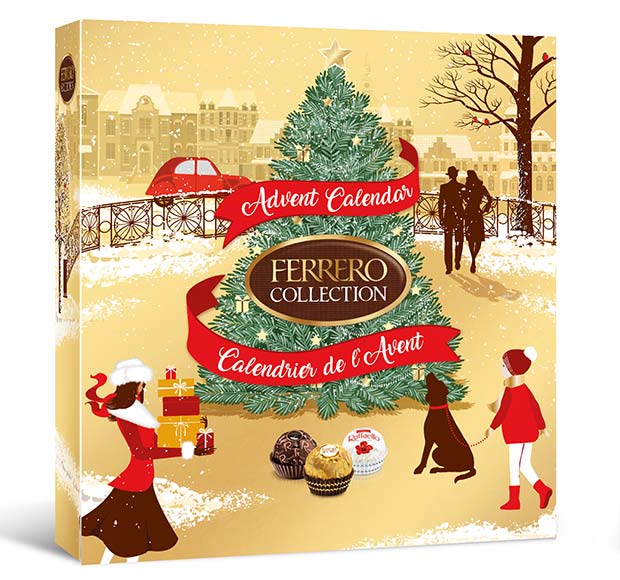

Advent Calendars were also high on the agenda for shoppers, and chocolate advents were still the number one for intent. 49% of Britons purchased an Advent Calendar ahead of Christmas 2019 and 80% of these shoppers bought a chocolate advent calendar (YouGov). Families are still the most important buyers, accounting for 37% of all purchases.

Novelties and Kids Seasonal Confectionery also experienced some positive performance.

Boxed chocolate was the big star within 2019. Self-treat in impulse saw a growth of nearly 3%. The success of gifting was down to existing shoppers making more trips than the previous year. Last year we didn’t get any more shoppers in but they shopped more often. With that insight you can say smaller retailers who pick up the third or fourth shopping mission during that week are definitely the ones that benefit. So there is a lot of growth in smaller stores as well as bigger stores and of course you can’t ignore the big growth in online which has fuelled a lot of the growth, particularly around the big boxes.

How did Ferrero’s portfolio perform last Christmas?

It was a tough market throughout 2019, with many shoppers holding back their spending. That being said, Ferrero fared well in the Main Gift sector (the number two brand), as a result of our trusted brand and family favourites.

Our revamped Thorntons Classic was also a hit with shoppers, growing +20% in value vs last year, outperforming the market and growing the brand’s overall market share +0.4ppt (Nielsen). Thorntons Classic was the number one fastest growing value brand at Christmas in the top 15 (Nielsen). Thorntons Continental was also up 2% vs LY (Nielsen) – the SKU’s fourth consecutive year of growth, as the products continue to attract new shoppers into the category.

Kinder Surprise Santa 75g was the number one novelty last year and Kinder Surprise Hollow Figures 36g grew +229% in the convenience and impulse channel.

What marketing support do you have planned for the seasonal range?

We are making a £3m portfolio-wide investment this Christmas, including on our spreads brands. Our iconic brands will be unmissable on TV this Christmas. Rocher and Thornton’s will both be on TV and we have quite a lot of other above the line activity going on at the moment. We are also doing a lot of shopper activity. We continue to invest very heavily in our brands. We do see ourselves as being drivers of growth and we look forward to helping retailers grow sales this Christmas.

Comments are closed.