Baby food and milk continues to see dynamic growth, fuelled by rising birth rates and wider usage, largely on the back of NPD.

Baby food and milk continues to see dynamic growth, fuelled by rising birth rates and wider usage, largely on the back of NPD.

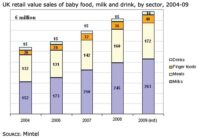

Sales value is estimated to have increased by at least 14% in 2008, to reach £456 million. Sales in the main product segment, milk, have been boosted by the Healthy Start scheme launched in late 2006, with rapid value growth in 2008 partly driven by global dairy price inflation.

While lower food and milk price inflation will dampen growth in current terms, an increase of 8% is expected in 2009, to take market value to £491 million. Although PDI is expected to fall in the economic crisis, most parents seem reluctant to cut back on their baby’s food.

Seen as closely related to the baby’s health and wellbeing, Mintel expects the baby food market to be better insulated from the effects of the downturn than most. However, some parents are still put off by ready-made baby food because they perceive the brands to fall too far behind the purity of home-cooked food.

Within the market, solid growth in milks has been fuelled by rising birth rates and the increased use of follow-on, growing-up, and RTF milks.

Meanwhile, finger food sales doubled between 2004-09, the fledgling category expanding thanks to active NPD and keen interest from parents.

Sales of organic baby foods account for a fifth of total market value in 2008, with a high share in finger foods but notably low in milks.

Looking at innovation within the market, smaller brands lead NPD, accounting for more than three quarters of new launches in 2008.

Tubs and flexible packaging – offering convenience – currently dominate NPD. While ‘Natural’ and ‘convenient’ are the leading ways to position baby foods, both with high appeal to parents.

In terms of distribution, leading grocers dominate baby food sales, attracting parents with keen pricing and a comprehensive baby products offer.

Other retailers have found it difficult to compete on price, although smaller local retailers have benefited from The Healthy Start voucher scheme.

More baby food brands are now establishing their own online stores, though the channel still remains marginal.

Many baby food brands now operate an online store, and for the smaller brands, not stocked by major retailers, this is the main channel to market. Door-to-door delivery of handmade food, offering freshness and convenience, can be a strong selling point.

Widely distributed brands like Plum Baby and HiPP have also launched online stores, which contributes to visibility online and availability where the local store does not stock the products.

Grocery shopping online has gained ground in recent years, on the back of a major push by the major grocers. However, the channel remains marginal, estimated to have accounted for about 3.5% of food retailers’ sales in 2008.

According to consumer research, parents of small children are more likely than average to feel that they spend a lot of money on food. They are also keener to try new products which is a reflection of their younger age, suggesting that newness and variation can attract their interest in the baby foods aisle.

Comments are closed.