Worth £627 million in 2010, the market for analgesics has grown by 11% in value over the past 5 years. But in the last two years, growth in consumer expenditure on over-the-counter (OTC) analgesics has slowed. Recession is not the sole explanation. The proportion of adults using analgesics has declined and cheaper own-label products have put price pressure on branded products.

Worth £627 million in 2010, the market for analgesics has grown by 11% in value over the past 5 years. But in the last two years, growth in consumer expenditure on over-the-counter (OTC) analgesics has slowed. Recession is not the sole explanation. The proportion of adults using analgesics has declined and cheaper own-label products have put price pressure on branded products.

The positive news for analgesics is that they remain an essential store cupboard item – indeed, some 83% of adults who use painkillers always keep a supply at home. So demand is unlikely to change significantly, even in a recession.

Although demand has not changed dramatically, explosive growth in sales of own-label products has taken place, creating stiff competition for the leading brands. In the recession, some consumers appear to have re-evaluated their spending priorities becoming thriftier and trading down to basic alternatives. More than half of users are satisfied with own-label products and one in five users just choose the cheapest price.

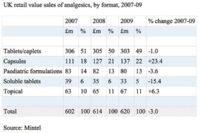

In terms of format, tablets/caplets are the most popular type, due to their wide availability and cheaper prices but value share is falling, because cheaper own-label drugs are gaining market share. Between 2007-09 sales fell by 1%, leaving tablets with just under half of the market with sales of £302 million. Capsules grew sales by 23% over the same 2 year period to reach 23% of the market by value. Many of the newer added-value products have adopted a capsule format, helping to grow demand. New product development has helped to arrest decline for paediatric formulations, which saw a slight downturn in sales of almost 4% over 2007-09 to £80 million. Meanwhile, Topical painkillers have also enjoyed new product developments, particularly patches for relief of back or joint pain. Sales grew by 6% over 2007-09 to reach £67 million.

Self-medicating is commonplace among adults. Today, eight out of ten people say they have to feel really ill before going to the doctor, indicating that they will take responsibility for diagnosing/ medicating themselves when they feel they must. But an element of caution remains: over half usually wait for the pain to go away on its own, without taking medication.

Even though the vast majority of people have some painkillers close at hand, only 16% see them as the only treatment for pain.

Meanwhile, only 13% reach for the painkillers at the first sign of pain. The market for painkillers could grow further if more people were to trust the safety and efficacy of painkillers and take them at an earlier stage when pain strikes.

In terms of distribution, grocery multiples have been gaining market share of OTC analgesics and in 2009 accounted for 55% of the market by value. Their success is helped by convenience, a good own-label offering and comprehensive choice.

Chemists/drugstores are losing share and account for 33% of sales of analgesics in 2009, down from 36% in 2007. Convenience stores are recognising the potential in analgesics and together with discount and general retailers their share was 12% in 2009.

Comments are closed.