- British shoppers plan ahead for Easter as sales of confectionery increase by +34%, whilst sales for home (+61%) and garden items (+92%) soar ahead of spring

- Total Till sales decline by -2.9% but British shoppers spend £1bn more on groceries in the last four weeks compared to the same period in 2019, pre COVID-19

British consumers spent £439m on confectionery ahead of Easter in the four week period ending 27th March 2021, a +34% increase in sales compared with the same period in 2020. Moreover, as non essential retail remained closed, consumers turned to supermarkets to treat themselves as sales of clothing doubled (+106%) to £313m whilst sales of home (+61%) and garden items (+92%) collectively increased to £175m, with shoppers planning for spring and post-lockdown living, reveals new data released today by NielsenIQ.1

In contrast, sales of packaged grocery fell by -24% and household goods (such as cleaning and paper products) fell by -31% compared to last year1 – which coincides with the stockpile shopping heights of March 2020. As the UK edges closer to the end of the lockdown period, March this year signalled the end of pandemic purchasing. This impacted overall grocery spend, where total till sales fell by -2.9% in the last four weeks. Despite this, when compared to the same period in 2019, before the pandemic, this amounts to an overall 14% growth in sales as British shoppers spent £1bn more on groceries in the last four weeks than they did in 2019.2

NielsenIQ data shows that in the last four weeks, online grocery sales remained high, growing at 92%, whilst bricks and mortar sales declined by -14% year on year.

While overall growth declined in the last four weeks, the picture for the first quarter of the year indicates that sales are now levelling off, with industry growth of +5.7%, down from +8.6% in the last quarter of 2020.

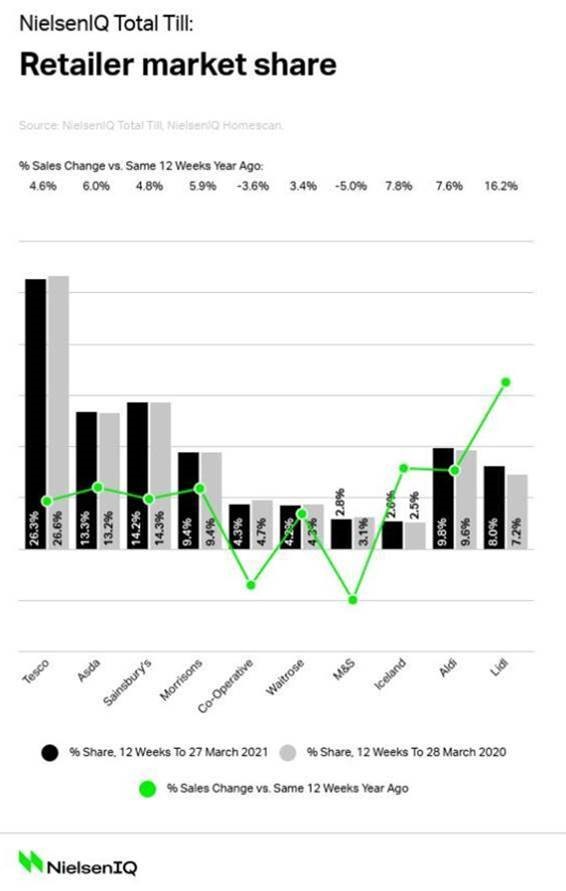

In terms of retailer performance, Lidl (16.2%) grew the fastest over the last 12 weeks. Iceland (7.8%) and Aldi (7.6%) also performed strongly. Meanwhile, Asda (6.0%) and Morrisons (5.9%) were the fastest growing supermarket of the ‘big four’ retailers.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “It’s clear that as we draw ever closer to the end of lockdown, consumers have been looking ahead to spring and indulging in some retail therapy, ranging from Easter chocolate to some new clothing or accessories for the home and garden.”

Watkins continues: “With the economy slowly reopening we will soon see a rebalancing of consumer spend in the months ahead. As 80%3 of consumers say they would feel confident returning to restaurants once they’ve had their vaccine, many billions of pounds are set to return to cafes, pubs and restaurants which could impact on grocery sales. But, with the likelihood of a ‘stay at home summer’ supermarkets are still well-positioned to capture incremental spend.”

Watkins concludes: “However, one in three (35%)4 British consumers are now newly constrained, having faced a decline in household income or financial situation and are now watching what they spend much more — up from 29% in September. These multiple factors mean that it is still unclear how all consumers will respond post-lockdown, and how exactly their shopping habits towards food and drink with change still remains to be seen.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Comments are closed.