No post-Christmas recovery in FMCG as total till sales remain subdued at +0.7% in the last four weeks

There was no post-Christmas recovery for UK supermarkets this January as sales grew by only +0.7% in the last four weeks, reveals data released today by Nielsen.

This figure is significantly less than the same period last year, in which retailers were revelling in a +3.3% growth. This year, value sales since Christmas fell at the grocery multiples by -0.3%, with volumes also down -1%. This was exacerbated by inflation, which was only up by +1.6%1.

The continuing mild winter weather was also not enough to give a seasonal boost, with volume sales of traditional ambient grocery products down by -2.8%. However, there was reasonable value growth in soft drinks (+2.8%), crisps and snacks (+2.6%), and confectionery (+2.2%). Beer, wine and spirits also recovered from a poor December, with an uplift of +2%2.

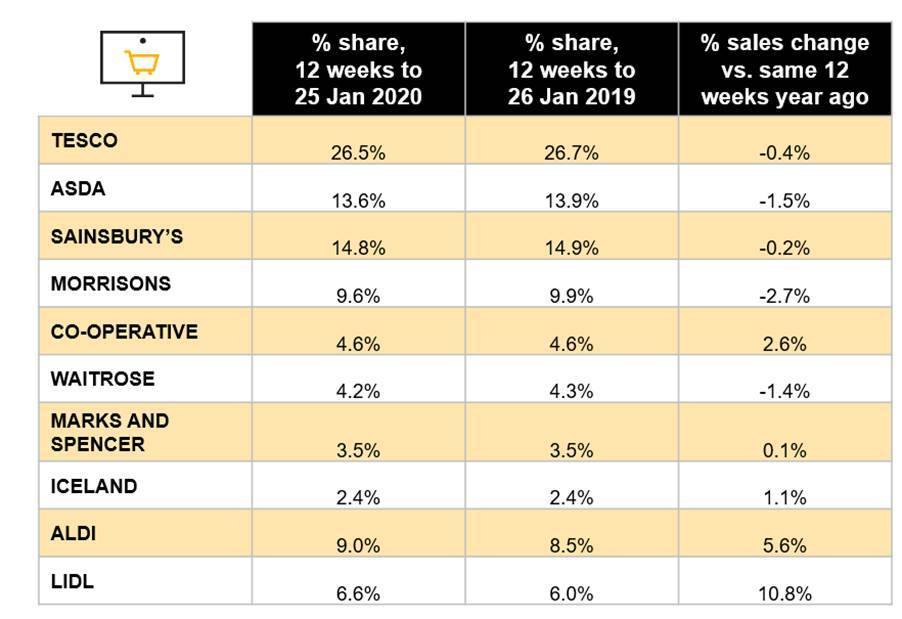

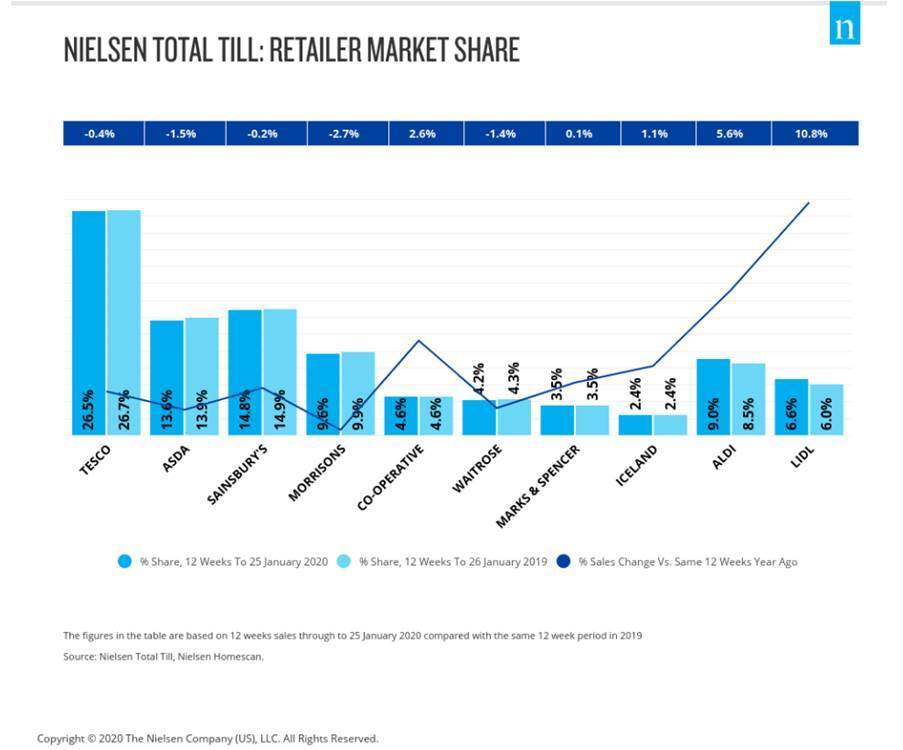

Nielsen’s data also shows that sales were weak at all of the supermarkets over the last 12 weeks to 25th January, with the only growth coming from Marks & Spencer (+0.1%), Iceland (1.1%) and the Co-operative (+2.6%). The discounters Aldi (+5.6%) and Lidl (+10.8) also experienced a rise in sales. With topline growth still elusive for most retailers, price cuts and vouchering continued to be used by the ‘big four’ supermarkets to entice customers, with a focus on big name brands in the last four weeks. This has led to consumer spend on promotions being maintained at 26% of sales.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “We know that shoppers are always more conscious of their spending after Christmas, yet this behaviour is impacting the basket more so now than last year. Overall, the number of items purchased per trip is less than last January, resulting in lower supermarket spend – even if visits to stores are up.

Watkins continues: “‘Little and often’ is still the underlying shopping behaviour, and with shoppers less inclined to spend on a big shop, sales at the Co-op and other smaller store formats, were more buoyant. Although sales have continued to increase at the discounters, growth at Aldi has fallen behind Lidl, and whilst they are both attracting new shoppers and visits to stores are up, they face the same pressures as the rest of the industry in maintaining spend per visit “

Watkins concludes: “The good news is that consumer confidence is improving, compared to where we were six months ago. However, this change in sentiment will take a number of months to be reflected in sales. The economy remains firmly our number one concern, followed by political stability, health and rising utility bills3. Assuming there is no late winter disruption, we anticipate that industry growth will improve to around 1% over the next couple of months, whilst volume growth will remain relatively weak until Easter, where this holiday should provide much needed momentum mid-April.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

The figures in the table are based on 12 weeks sales through to 25 January 2020 compared with the same 12 week period in 2019

Source: Nielsen Total Till, Nielsen Homescan

Notes

Unless otherwise stated all data is Nielsen Homescan Total Till

1 BRC Nielsen Shop Price Index January 2020

2 Nielsen Scantrack Grocery Multiples

3 The Conference Board® Global Consumer Confidence™ Survey in collaboration with Nielsen

Comments are closed.