- Weekly sales growth at UK supermarkets peaked at +14.8% in the week ending 25th December 2021 as consumers opted for last minute in-store purchases ahead of the festive period

- Total Till grocery sales grow by +1.0% over the last four weeks ending 1st January 2022, a strong performance against tough comparatives during the same period last year. Growth over the full 12 weeks was -1%.

- Brits spent £14bn on ‘Christmas categories’ at UK supermarkets over the 12 weeks with soft drinks a winning category

UK shoppers spent a total of £7.1bn at UK supermarkets in the two weeks ending 25th December with weekly sales peaking at +14.8%1, reveals new data released today by NielsenIQ. This figure exceeds previous forecasts from analysts at NielsenIQ, in which sales were predicted to grow to £6.8bn, up from £6.7bn in 2020.

Data from NielsenIQ reveals that Total Till grocery sales across the four weeks ending 1st January 2022 grew by +1.0%. This is an impressive growth rate, as it is against strong comparatives in 2020, where sales had accelerated +8% in anticipation of a full lockdown from 4th January 2021.

According to data from NielsenIQ, online shopping visits fell -1.7% over the four week period whilst in-store visits jumped to +6.3%. This reflects the changing shopping behaviours of UK consumers, who are continuing to embrace an omnichannel shopping mindset.

With shoppers encouraged to book online slots well in advance of Christmas, Brits then opted to shop in-store for last minute essentials in the final two weeks. As a result, NielsenIQ data shows that there were 27m more in-store visits during this four week period compared to 2020, leading to the online share of grocery sales falling to 11.3%, compared to 12.1% in December 2020. This is the lowest online share since the 11.6% of April 2020 following the start of the pandemic.

Christmas entertaining boosts key categories

NielsenIQ data shows that Brits spent £14bn2 on Christmas categories at UK supermarkets, an increase of +8.7% compared with pre-pandemic levels in 2019. Moreover, soft drinks was a winning category, with growth of +14.5% compared with 2019, and up +9.4% in 2020.

Sales of fresh oriental ready meals grew by +20%, whilst sales of vegetarian burgers were up +19% as shoppers sought alternatives to traditional festive food.

As Brits were able to get-together over the Christmas period and entertain with friends and family, there was also a surge in snacking and party food, with chilled baguettes (+18%), fresh trifle (+8%) and fresh sausage rolls (+7%) increasing in sales in the four week period ending 1st January 2022. Moreover, sales for chocolate confectionery were up +8%, with UK shoppers spending an estimated £380m in this category over the same period.1.

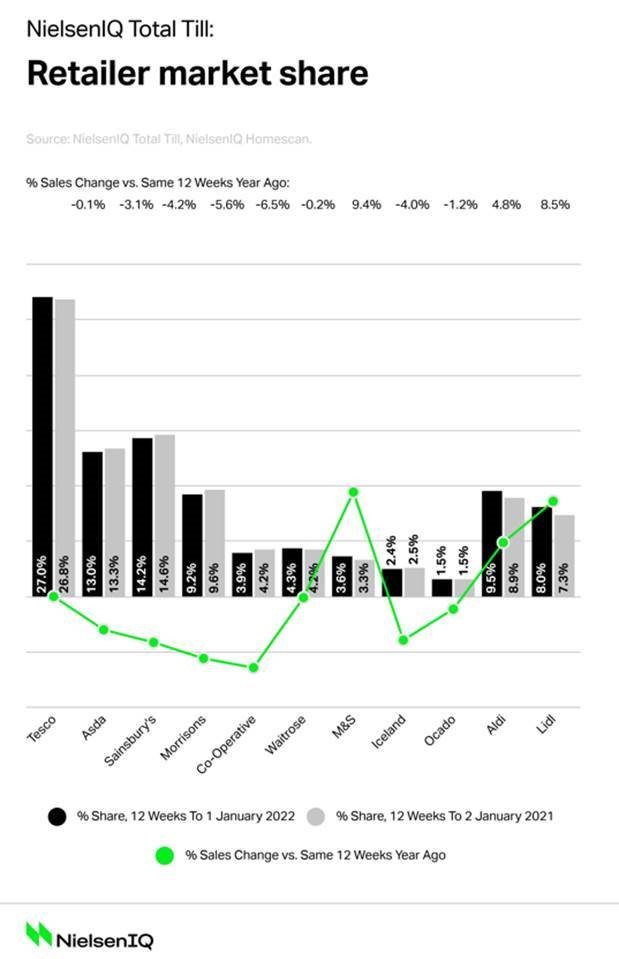

With weaker comparatives and shoppers in the mood to enjoy Christmas this year, M&S (+9.4%) was the fastest growing food retailer over the 12 week period, whilst Lidl (+8.5%) and Aldi (+4.8%) both benefited from an accelerated new store opening programme. Tesco (-0.1%) and Waitrose (-0.2%) also gained market share.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “Omnichannel purchasing, shopping around, and entertaining at home were the big shopping trends over the festive period. All retailers had more shoppers than this time last year and most had more visits, even if spend per visit was a little lower at just over £21. British consumers are continuing to adopt an omnichannel approach and whilst online allows them to plan ahead, shoppers are increasingly heading in-store for a regular weekly shop as well as for last-minute purchases and we can expect this behaviour to continue.”

Watkins concludes: “It was a good Christmas for food retailers with overall performance in line with expectations in the last three months, and against some very tough comparatives last December and in a very competitive retail environment. Shoppers were willing to buy the extra Christmas indulgences and temporarily put aside their concerns about the rising cost of living. Looking ahead, consumers are facing significantly higher energy, travel and other household costs so it’s likely that shoppers will look to make savings on their weekly food shop by managing budgets. We may see them buying what they need when they need it, wasting less fresh food, and steering clear of unnecessary cupboard stocking. This would give added momentum to the return of the ‘little and more often’ macro trend we are anticipating as we hopefully leave behind the pandemic shopping behaviour in the new year.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Comments are closed.