- FMCG sales growth at supermarkets continue to level out at +5.3% over the last four weeks ending 5th September 2020

- Online FMCG sales continue to soar at +102%, with 10% more online shopping ‘trips’ over the last 12 weeks

UK supermarket sales finally begin to stabilise at +5.3% year-on-year growth over the four weeks ending 5th September 2020, after an extended period of accelerated growth. However, new and permanent changes appear to be emerging in shopper behaviour, reveals new data released by Nielsen.

UK supermarkets have continued to experience strong online sales in the last four weeks, with Nielsen data showing that online FMCG sales were up again by +102%. Nielsen data also shows that in the last 12 weeks ending 5th September, supermarkets experienced 10% more online shopping ‘trips’ than in the 12 weeks leading to early June 2020, when lockdown was lifted. Which means, online shopping is sticking and those shoppers are shopping more often, driving growth in the channel, reveals new data released today.¹

This had an impact on bricks and mortar sales, which fell by 1.6%. However, sales across the convenience channels continued to grow, and were up +6.4% in the last four weeks ending 5th September. Overall, spend per visit across all formats – including online – was up by +22% compared to the same time last year.

Beers, wines and spirits (+15%) and frozen food (+11%) continued to be the strongest categories. UK consumers were in the mood to celebrate the summer as champagne sales grew by 24% and sparkling wines by 17%. The warm weather led to a short period of alfresco dining, helping drive more sales for fresh meat, fish and poultry (+7%) and unsurprisingly giving ice cream a boost (+18%). However, with many workers still working from home and children not at school, and some supermarket counters still closed, sales for delicatessen and bakery products remained in decline (-4%). Spend on packaged, shelf-stable grocery products also began to slow to +7%, down from +18% in early July, whilst the lack of holidays and trips contributed to health and beauty sales declining by 3%2.

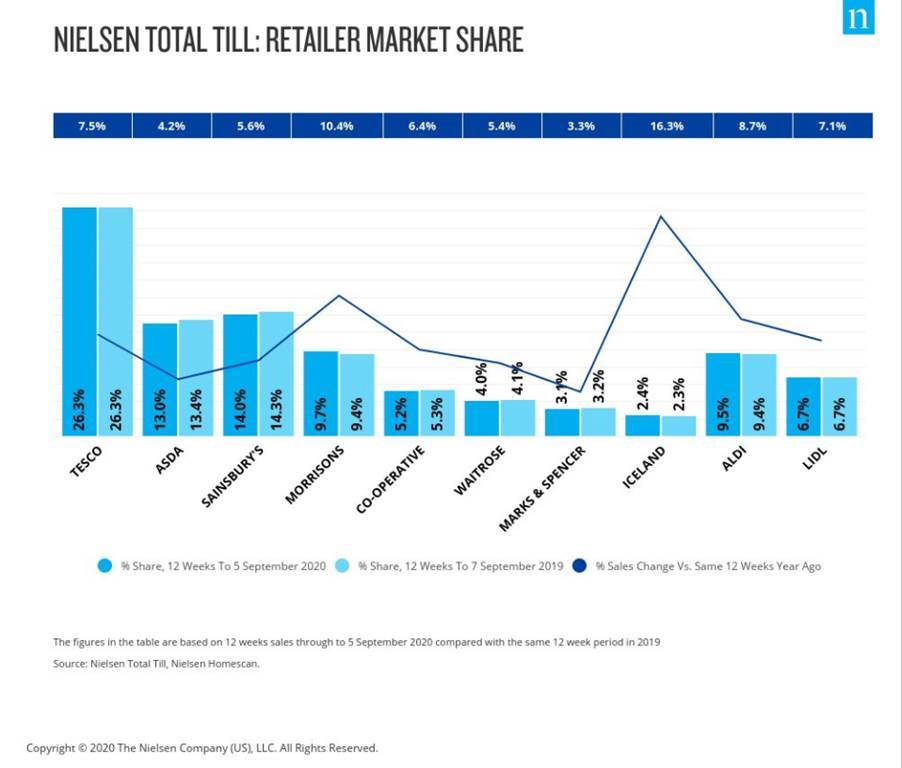

In terms of retailer performance, over the 12 weeks ending 5th September, Iceland (+16.3%) remained the fastest growing retailer, just ahead of Morrisons (+10.4%) and Aldi (+8.7%).

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “The growth of online shopping continues to put pressure on stores, with grocery spend at bricks and mortar stores falling again, by almost 2%. Whilst there are still shoppers trying online for the first time, the growth of online is now being driven by bigger spends and more transactions. This continued growth in online over the last 12 weeks reflects increased capacity as supermarkets respond to shopper demand and continue to improve efficiencies in the delivery network.”

Watkins concludes: “Food retail sales are still being boosted by households working from home, and such disruptions are expected to continue for the foreseeable future. However, with more Covid-19 headwinds set to come and a fragile economy, a weakened shopper sentiment will likely start to impact consumer spend overall. Many retailers are re-positioning their strategies, launching new ad campaigns and focussing on price cuts. However, we anticipate that the supermarket industry will remain more resilient than other types of consumer spending and expect a +6% sales growth for FMCG in the last few months of the year, compared to the flat growths seen at the end of 2019.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

The figures in the table are based on 12 week sales through to 05 September 2020 compared with the same 12 week period in 2019

Source: Nielsen Total Till, Nielsen Homescan

Notes

Unless otherwise stated all data is Nielsen Homescan Total Till

1 Nielsen Homescan FMCG (4 weeks to 5 Sept 2020)

2Nielsen Scantrack Grocery Multiples (4 weeks to 5 Sept 2020)

Comments are closed.