- During the first week of hospitality reopening, grocery sales at UK supermarkets declined by 6.7%, with overall Total Till grocery sales falling 2.7% in the four weeks to 22nd May 2021

- However this is still an 11% rise versus May 2019 reflecting entrenched behaviour changes

- Brits maintain their spend for groceries online, with shopper penetration remaining high at 28% of households, and £1.25bn spent online in the last four weeks

Total Till sales fell 2.7% in the four weeks ending 22nd May 2021, with grocery sales declining by 6.7% during the week ending 22nd May,1 the first week indoor cafes, pubs and restaurants reopened, reveals new data released today by NielsenIQ. This also coincided with a summer heatwave and an earlier late May bank holiday last year.

However, despite this fall in grocery sales, food retail sales increased almost 11% compared with the same period in 2019, with shoppers spending £9.1bn2 over the four week period. Without the requirement to limit unnecessary travel, NielsenIQ data also shows that visits to stores are up by 20% compared to the same period last year. However, with more frequent visits, spend per visit has fallen to £17.40 from £21.50 in May 2020. Shoppers will also be spending more at travel outlets and other ‘food to go’ establishments.

NielsenIQ data indicates that UK shoppers are continuing to embrace online grocery shopping, with 28% of UK households still shopping online in the last four weeks – the same figure as a year ago – and considerably more than the 17% in May 2019. As a result, Brits spent £1.25bn online in the last four weeks ending 22nd May. Moreover, the online share of grocery sales remained strong at 13.8% – exceeding the 13.4% market share recorded in May 2020, but a slight decline on last month’s figure of 14.2% 2.

In terms of category performance, delicatessen (+18.6%) is the fastest growing supercategory followed by health and personal care (+16.2%) and bakery (+10.8%). This is as a result of lockdown restrictions easing, with more opportunities to socialise outdoors and many people returning to the office. As a result, frozen food sales saw the biggest decline (-14.9%) as well as packaged grocery (-10.1%) alongside beers, wines and spirits (-6.7%), as consumers returned to visiting pubs, bars and restaurants.1

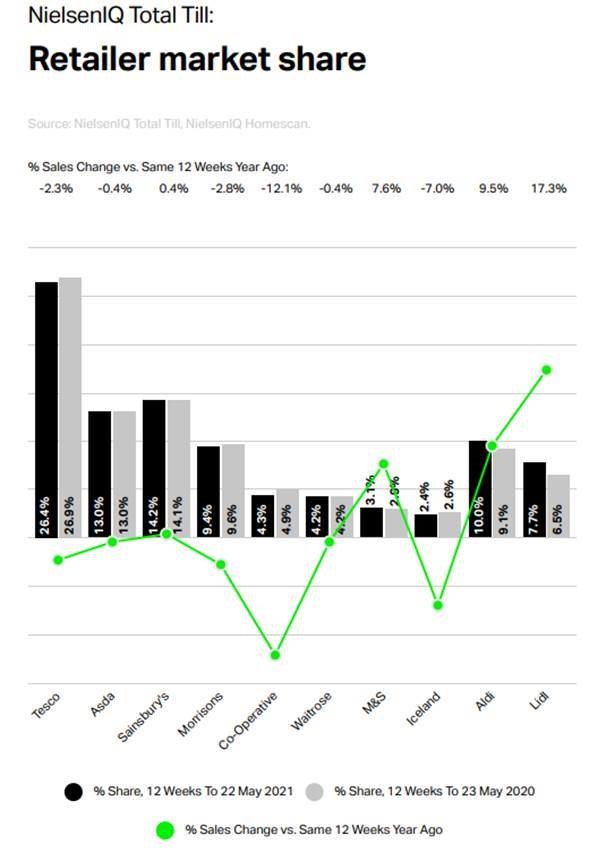

In the last 12 weeks Lidl (+17.3%), Aldi (+9.5%) and M&S (+7.6%) led growth, whilst Sainsbury (+0.4%) was the fastest growing retailer out of the ‘big four’ supermarkets, just ahead of Tesco, Asda and Morrisons.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “Despite lockdown restrictions easing, it is evident that online grocery remains popular with British consumers, with almost one in three households still choosing to shop online. This suggests that the shift of spend to online that we saw over the last year is now a more permanent fixture for many and part of regular grocery shopping routines. With supermarkets placing more investment in their rapid delivery and fulfilment, shoppers are no longer seeing this only as an option for one large shop. Usage is evolving to meet a wider range of shopper needs and meal occasions, no matter the basket size.”

Watkins concludes: “Looking ahead, the challenge for food retailers is to reassess shopping behaviour now when their customers have opportunities to spend elsewhere across leisure, hospitality and travel, particularly when restrictions are permanently lifted at the end of the month. However, with the start of warm weather, Euro 2021 on the horizon, and the likelihood of more stay at home UK holidays, there will still be opportunities for supermarkets to increase basket spend and improve sales as we head into the summer months.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Comments are closed.