Over half of UK consumers (53%) claim that the cost of their normal weekly grocery shop has risen in the last six months, reveals new insight released by NielsenIQ, in its new Economic Divide study, which identifies five new consumer groups, and how this will shape consumer shopping behaviours in the year ahead as Britain prepares for soaring UK inflation.

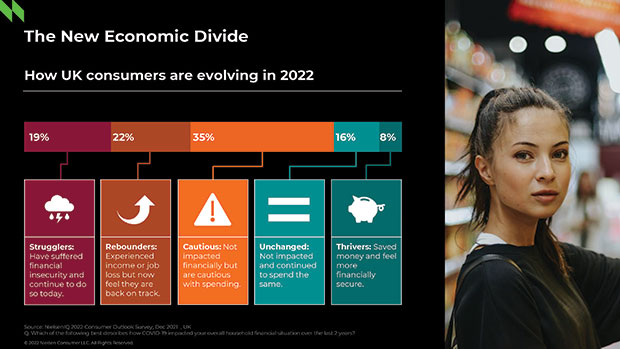

The five new consumer groups, identified by NielsenIQ, are based on the pandemic’s economic impact on consumers’ financial security and associated spending patterns and are each shaped by their unique circumstances and approach to endemic living:

The five new consumer groups, identified by NielsenIQ, are based on the pandemic’s economic impact on consumers’ financial security and associated spending patterns and are each shaped by their unique circumstances and approach to endemic living:

Strugglers: This is 19% of Brits surveyed, these consumers experienced job or income loss and continue to do so today

Rebounders: Making up 22% of consumers, these shoppers experienced job or income loss during COVID-19, but are back on track now

Cautious: The most widespread (35%), these consumers did not see an impact on their household’s financial security during COVID-19, but are still cautious with spending habits

Unchanged: For 16% of Brits, there was no impact on their household’s financial security and continued to spend as they normally did

Thrivers: Making up just 8% of consumers surveyed, they saved money during COVID-19 and feel more financially secure now than they did prior to the pandemic.

Rising grocery prices noticeable with all consumer types

These segments demonstrate that 76% of UK consumers overall are cost-conscious consumers who are altering their buying and consumption patterns.

Over half (53%) of all Brits are also noticing the increasing cost of their weekly grocery basket in the last six months, rising to 70% of the consumers identified as strugglers.

Although ‘thrivers’ are the most financially secure, they too have noticed a climb in grocery spend (62%), despite purchasing the same items.

Different approaches to managing spend

In terms of managing grocery spend amid rising costs, 16% of all UK consumers have taken a radical approach and stopped buying certain products completely. The biggest consumer group to make such changes is the strugglers (21%), slightly below the global total for this consumer group (23%).

According to data from NielsenIQ, 21% of all UK shoppers select the lowest priced product irrespective of brand, with this figure climbing to 27% for strugglers. Meanwhile, thrivers are the least likely to make this choice, with 13% saying they choose to stick to their preferred brand (13%) irrespective of price.

In an interesting shift, NielsenIQ data shows that thrivers are the most likely to buy whatever brand is on promotion (21%) followed by the cautious (19%). Thrivers are also more inclined (19%) to wait until their preferred products are on promotion to buy, just behind the strugglers (20%).

In line with the global total (69%), in-store grocery shopping at a hypermarket or supermarket remains the preferred method for UK consumers (61%), rising to 66% across the cautious, unchanged and thriver groups.

However, when it comes to ordering online, this is most popular among the strugglers, with a combined total of 84% either ordering groceries online for delivery or pick-up at either a supermarket, local traditional store or from a pure-player like Amazon. This is above the global total (83%) as well as the overall UK total figure (66%).

Rachel White, Managing Director, NielsenIQ UK and Ireland, said: “The last two years have seen an unprecedented level of uncertainty for consumers and the war in the Ukraine has only exacerbated sentiment about rising cost of living and inflation. In order to adapt to how consumers are reacting, retailers and manufacturers will need to forge new strategies and reinvent portfolios as they navigate these changing needs and priorities of a divided consumer landscape.”.

* The new NielsenIQ Economic Divide 2022 survey was conducted in November to December 2021 by NielsenIQ Global Thought Leadership across 17 markets

Comments are closed.