Since 2004, lager value sales have fallen by 11% to reach £11.4bn in 2009. Nevertheless, it remains the largest selling alcohol drink.

Since 2004, lager value sales have fallen by 11% to reach £11.4bn in 2009. Nevertheless, it remains the largest selling alcohol drink.

In terms of market growth in the past 5 years, the lager market first stalled between 2004 and 2006 and then declined from 2007 onwards. Although the recession has tipped the market over the edge, it was already in trouble due to challenging market conditions that are affecting all drinks advertisers: that alcohol consumption is declining year on year, meaning a decreasing pool of potential customers.

Nevertheless, lager remains a very strong market. In value sales, it is worth more than any other drink type, even wine. This is despite seeing its value fall from £12.7 billion in 2004 to £11.4 billion in 2009 – a 10% drop. Also, the top three selling brands of the entire alcohol market are lager brands (Carling, Foster’s and Stella Artois).

The main problem for the market is also its biggest opportunity; it remains heavily focused on its core audience of young (18-34) men, with consumption levels for women and those aged 35 and over dropping off considerably. The penetration of women is particularly low, with twice as many male drinkers as female. This means that if lager can increase its appeal to a broader demographic, and cider has recently shown how this is possible, it has the potential to arrest the decline.

According to exclusive consumer research, whether lager is served extra cold is the greatest motivator when choosing between brands, influencing 4 million regular lager drinkers/potential drinkers. Second is provenance, with 3 million being influenced by whether a lager brand is from a traditional beer making country e.g. Czech Republic.

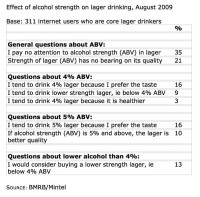

Interestingly, the research also shows while the trade defines premium lager as having an ABV (alcohol content) of around 5% and above, only one in ten regular lager drinkers think that stronger lager is better quality. Indeed, since 2003, standard lager (usually an ABV of around 4%) has become increasingly popular compared to premium, and now accounts for three out of every five pints drunk.

Women want very different things from men, being especially motivated by lager brands that are low in calories and have a different flavour to normal, eg lemon/lime. This suggests marketing fruitier lager that is to be drunk more slowly, like wine, will have particular appeal for them. The fact that comparable measures of lager have lower calories and are less strong in ABV than wine can help persuade them to add lager to their drinking repertoire.

In terms of distribution, the majority of lager’s sales by volume come from pubs, which have been in decline for a number of years. As a result, lager sales from pub outlets decreased by around a fifth between 2004 and 2008.

Supermarkets continue to grow their share of sales, which presents challenges for premium lager brands trying to justify higher on-trade prices, when prices are so much lower in the off-trade.

Comments are closed.