With rising prices and the economic downturn at play over the past few years, the in-home coffee market has weathered the storm well. Between 2005 and 2009 the UK market for in-home coffee grew by as much as 17% in value. Although some of this growth is attributed to the hike in raw coffee and production costs, trading up has been a key feature of the market. And things are continuing to look upbeat, with sales of coffee set to steam ahead. Valued at £782 million in 2009, the market for coffee is forecast to grow by as much as 25% by 2014, when the market will hit the £976 million mark.

With rising prices and the economic downturn at play over the past few years, the in-home coffee market has weathered the storm well. Between 2005 and 2009 the UK market for in-home coffee grew by as much as 17% in value. Although some of this growth is attributed to the hike in raw coffee and production costs, trading up has been a key feature of the market. And things are continuing to look upbeat, with sales of coffee set to steam ahead. Valued at £782 million in 2009, the market for coffee is forecast to grow by as much as 25% by 2014, when the market will hit the £976 million mark.

However, one area the industry is particularly concerned about is the lack of uptake amongst younger consumers. Although the over-55s represent the biggest coffee users, and are themselves a powerful buying group, the market stands to lose a considerable proportion of drinkers if younger consumers do not develop a taste for the product going forward. The age of 35 appears to be a major turning point for coffee drinking, with coffee consumption rising considerably among 35 to 44 year-olds and steadily thereafter.

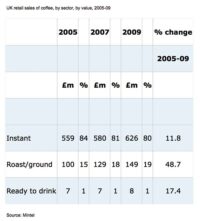

Good old “instant” (£626 million) remains the nation’s favourite coffee, accounting for 80% of value sales in 2009. Total sales of instant grew by 12% between 2005 and 2009. Meanwhile, sales of roast or ground coffee (£149 million) account for 19% of sales. Sales of this variety grew by an energising 49% over the same 5 year period. Worth just £8 million in 2009, ready-to-drink coffee accounts for the remaining 1% of the market.

The premium freeze-dried, super-premium and speciality sectors have been responsible for driving growth within the instant sector, as shoppers of these upmarket varieties are less likely to be bulk-buying promotions than the regular category. Within the sector more and more consumers are trading up, switching to premium formats such as roast and ground coffee. Valued at £201 million in 2009, sales of premium (freeze dried) coffee rose 44% between 2005 and 2009, accounting for as much as 36% of instant value sales.

Meanwhile, sales of regular granules have been in decline for some time. Seen as the less innovative and the value option in the market, regular granules fell a massive 36% over the same 5 year period, to just £140 million in 2009. Today, they account for just a quarter (25%) of instant coffee market sales.

With a 14% value share, sales of speciality coffee grew by 17%, while super premium (accounting for a 13% share) grew by 18%. Once all the rage with the nation’s health freaks, decaffeinated coffee has witnessed an 8% decline in the past year, accounting for 11% (£62 million) of instant sales in 2009. Finally, with a share of just 1%, powder is valued at just £6 million.

Finally, in terms of distribution, multiples (66%) have maintained market share on the back of the greater usage of supermarkets for FMCG shopping in general. A wider base of consumers are lured through the doors by low pricing strategies and the broad range of cheaper own-label alternatives. Meanwhile, convenience stores, however, have underperformed the growth in the multiples, although within the sector the c-stores operated by the major grocery multiples have outperformed the rest of the sector.

Comments are closed.