- £5.7bn to be spent during the week ending 20th December, making it the biggest shopping week of the year

- 40% of UK households plan to use saved loyalty points and vouchers and 23% will shop around for promotions to maximise savings over Christmas

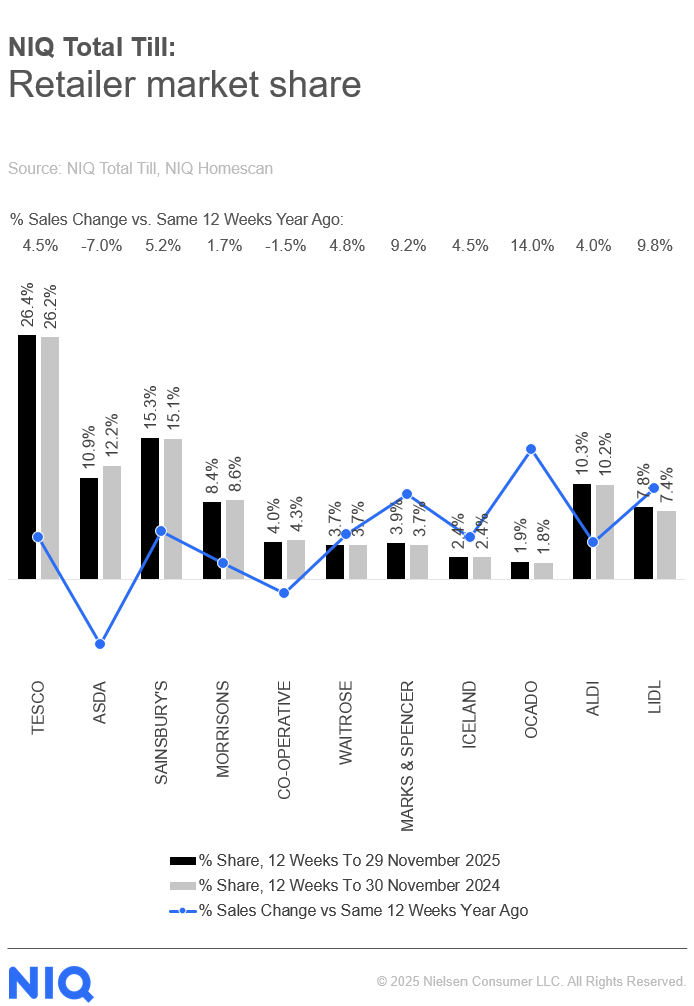

- Ocado (+14.0%) still leads the pack in retailer growth over the last twelve weeks, while Lidl (+9.8%) and Marks & Spencer (+9.2%) maintain good momentum

Total Till sales at UK supermarkets grew (+3.3%) in the last four weeks ending 29th November 2025, according to new data released today by NielsenIQ (NIQ). Despite this growth, NIQ data shows that shoppers are looking to prioritise savings on everyday essentials to spend on treats and indulgences over Christmas.

Overall sales on promotion increased slightly to 25% of FMCG sales over the past four weeks with in-store visits rising (+4.5%) as shoppers chased down deals. NIQ data shows that 17% of own label sales in the last four weeks were purchased on promotion – this is up from 16% a year ago with sales for brands on promotion remaining unchanged at 33%.1 And heading into December, NIQ data shows that 40% of households plan to use loyalty points and vouchers this Christmas with 23% intending to shop around based on prices and promotions. 2

In terms of category performance the fastest growing super category was fresh foods (+5.3%) with ambient foods growing (+2.6%) with an increase in sales of seasonal favourites in chestnuts (+28%), almonds (+11%) and sundried tomatoes (+19%), as shoppers opted for premium ingredients to elevate ordinary festive meals. 3

Shoppers are also stocking up on Christmas morning favourites, with frozen food sales rising (+2.1%), with frozen berries (+15%) and frozen croissants (+6%), as longer shelf life and value help households manage budgets and waste less food. 3

Sweet treats are also on the menu with confectionary, snacks and soft drinks sales rising (+4.5%). However, sales of beer, wine and spirits (BWS) fell (-1%) as shoppers look to enjoy the celebrations in moderation. 3

In terms of retailer performance, Ocado (+14.0%) remains the fastest growing retailer whilst Lidl (+9.8%) and Marks & Spencer (+9.2%) continue to maintain good momentum amongst the supermarkets. Sainsbury’s (+5.2%), Waitrose (+4.8%) and Tesco (+4.5%) also gain market share. All six retailers are expected to have a strong end to 2025.

Mike Watkins, Head of Retailer and Business Insight at NielsenIQ, said: “Shoppers are looking for an affordable Christmas this year and many have been holding back their spend with unit growths across the total store down -0.8%. Instead, they are spending wisely and making focused savings on the weekly shop to be able to buy some treats and indulgences for the family in December. The good news is that sales will now accelerate and over the four weeks to 27th December, we expect almost £20bn will be spent and if so, this would be a growth of around 2.8% on last year. 4

Watkins adds: “Retailers are showcasing their private labels strongly this year and are supporting their Christmas ranges with attractive offers and promotions. Premium private label is currently the fastest growing segment with a 8% growth in value sales and unit growth of 4% and looks set to gain further category share this Christmas.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Unless otherwise stated all data is NIQ Homescan Total Till.

1 NIQ Homescan FMCG

2 NIQ Homescan Survey November 2025

3 NIQ Scantrack Total Coverage

4 NIQ Scantrack Total Coverage (estimation)

Comments are closed.