- UK households shop cautiously as inflation impacts average spend per visit (+2.5%) which has increased every month since October.

- Protein (+9.6%) and fibre (+14.1%) based foods saw considerable growth in the last 26 weeks well ahead of total FMCG growth.1

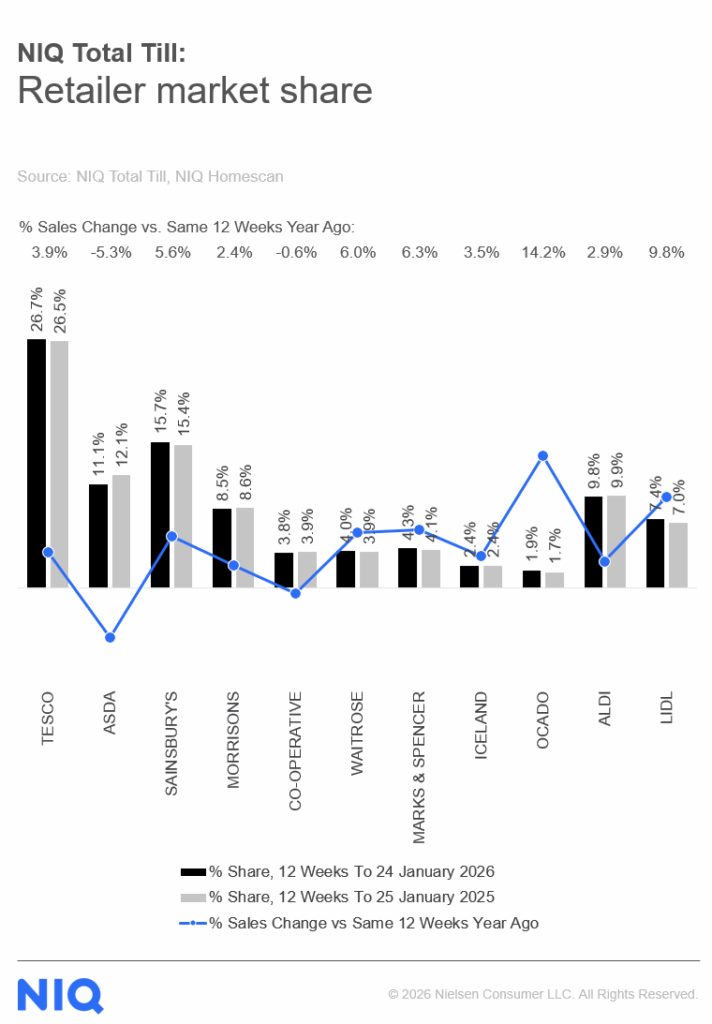

- Ocado (+14.2%) was the fastest growing retailer ahead of Lidl (+9.8%) while M&S (6.3%) and Waitrose (+6%) maintained strong sales due to Christmas and New Year spending.

Total Till sales at UK major supermarkets grew (+4.1%) in the last four weeks ending 24th January 2026, up from 3.0% in December, according to new data released today by NielsenIQ (NIQ). Despite this, NIQ data shows unit growths fell by -0.6% as shoppers took stock on personal finances after a busy Christmas period.

Inflation continues to impact UK households as it returns to the top of mind for many shoppers. The data shows that average spend per visit increased by +2.5%, amounting to ?22.08, impacted by inflation. Whilst frequency of visits was up (+1.4%), many households shopped cautiously for their weekly groceries as items in the shopping basket fell (-2.3%).2

As we saw last year, UK shoppers in 2026 are increasingly focusing on improving their health and wellness, with 1 in 4 households saying that Health is their number one priority for the year ahead. As such, shoppers are increasingly ‘looking behind the label’ as they seek out more knowledge about nutrition. 3

This impacted January sales as growing consumer awareness increased sales of both Protein (+9.6%) and Fibre (14.1%) based foods, resulting in considerable value growth in the last 26 weeks.1 And furthermore in the last 4 weeks, sales of Supplements (+18.4%) and Minerals (+9.2%) have seen generous growth. 4

In line with shoppers’ health and nutrition priorities, category performance saw Meat/Fish/Poultry (+7.7%) become the fastest growing super category with units also in growth (+1.3%). No/low alcohol drinks also gained share as No/Low Cider sales (+28%) and No/Low Spirits rose (+8%).4

eCommerce remains the fastest growing FMCG channel with value sales growth of +9.0% and market share increasing to 14.2%.5 There was continued softness in the Convenience channel with sales falling -0.4% against last year as shoppers shifted spend back to supermarkets and to online. 4 However, shopping missions remain at the core in a cold and wet January as Rapid Delivery saw a growth of +27% of their customer base vs last January. 6

Ocado (+14.2%) retained its position as the fastest-growing retailer ahead of Lidl (+9.8%). Meanwhile, at M&S (+6.3%) and Waitrose (+6%) sales were strong, helped by Christmas and New Year spending. Whereas sales at Co-op (-0.6%) dropped.

Mike Watkins, Head of Retailer and Business Insight at NielsenIQ, said: “Shoppers have entered 2026 with caution and a need to continue to balance budgets. This is felt most by two-thirds of households who still expect to be moderately or severely impacted by cost-of-living increases.”

“However, what’s interesting is that as well as a shift to essential food and drink there is continued interest in health and nutrition, fuelled by new product launches. For example, we are seeing a 20% boost to sales of cereal bars where there is a protein claim.” 1

Watkins added: “Looking ahead to Q1, with weak sentiment, some persistent inflation and shoppers looking to save money, we anticipate Total Till growth of around 3% to 3.5% and unit growth expected to remain stuck in the range of -0.5% to flat until Easter, or until the arrival of early Spring weather to kick start sales again.”

Unless otherwise stated all data is NIQ Homescan Total Till.

Unless otherwise stated all data is NIQ Homescan Total Till.

1 NIQ Product insights, 26 weeks to 10/1/26

2 NIQ Homescan FMCG

3 NIQ Homescan Survey November 2025

4 NIQ Scantrack Total Coverage

5 NIQ Scantrack eCommerce (Defined Multiple Grocers)

6 NIQ Digital Purchases

Comments are closed.