- The last four weeks saw Total Till growth slow (+1.1%) compared to same time last year

- In-store visits also down (-0.9%), however online grocery shopping saw a rise in sales (+3.7%), making it the fastest growing channel and online market share rising to 12.6% of FMCG sales

- Discounter market share remains unchanged (18%).

Total Till sales at UK supermarkets slowed (+1.1%) in the last four weeks ending 15th June 2024, according to new data released today by NIQ. This slowdown compared to the growth (+12.1%) reported the same period last year is largely due to wet weather in the early weeks of the month compared to almost four weeks of dry, sunny weather and an early June heatwave last year. Another contributing factor to this comparison is that food inflation had just peaked (+14.6%) this time last year. 1

Channel performance also felt the impact of the wet days as shoppers were more inclined to shop for groceries online rather than in the stores. In the last four weeks, in-store sales were down (-0.9%) while there was an increase (+3.7%) in online sales, boosting the channel’s share of FMCG sales to 12.6%, an increase from the 12.2% reported a year ago. 2 Conversely, Convenience store sales were particularly weak at -5.1%.3

With consumers staying indoors likely to avoid the rain, NIQ data shows that shoppers reverted to warming foods and chocolate treats. Confectionery (+6.7%) and packaged grocery (+6.7%) saw the biggest uplift in category unit sales, followed by meat, fish & poultry (+2.6%), and crisps & snacks (+2.1%) which also saw increases in unit growth. Shoppers also purchased more savoury baking mixes (+29%) and gravy and stock (+28%) and ambient soup (+21%).

And with less demand for instant refreshments against last year’s heatwave, beers, wine and spirits unit sales declined (-8.9%), while soft drinks (-12.5%), tobacco (-12.4%) and general merchandise (-9.9%) also saw a similar decline in unit sales. 4

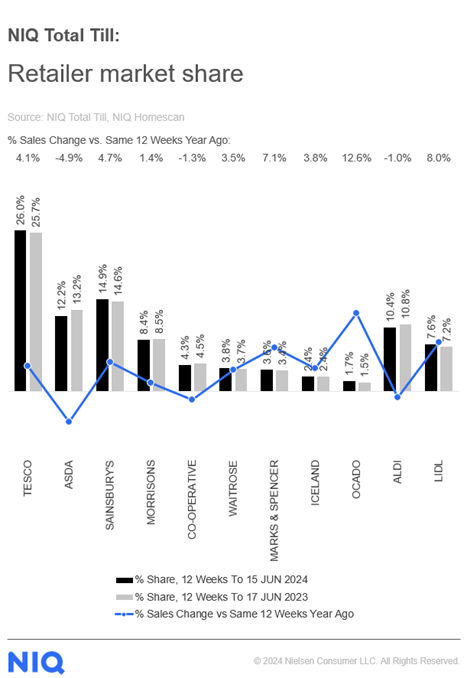

NIQ data over the last 12 weeks shows that the Discounter market share remains at 18%, with sales at Lidl (+8%) growing ahead of Aldi (-1%). However, Aldi had the highest growth of any retailer this time last year. Both retailers are still attracting new shoppers and also more visits, but their average spend per visit is down compared to this time last year.

Over the last 12 weeks Ocado (+12.6%) continues to outperform all retailers and M&S (+7.1%) also gained market share. Sales at Sainsbury’s (+4.7%) and Tesco (+4.1%) also increased which saw the retailers also gain market share. Whilst Morrisons’ market share is down slightly to 8.4%, the retailer has seen a +8% increase in FMCG spend per visit over the last 12 weeks. Asda (-4.9%) still has the weakest performance.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “The grocery sales uplift in June compared to May was much softer than this time last year which had the hottest June on record. Whilst the growth trends through to mid June look stark, we can now expect a lower level of growth for a number of months to come as we cycle through high inflation comparatives. We remain hopeful that current warm weather and England’s success at the Euros may boost sales of drinks and snacks.”

Watkins adds: “Now that discounter market share has plateaued, their growth for the rest of the year will be more dependent on new store openings and encouraging more visits. This will be needed to counteract some of the spend gained during the high period of inflation, which is now drifting back to supermarkets and may well continue over the next six months.”

Watkins concludes: “The year to date growth at the Grocery Multiples has slowed to +2.6% in terms of value and +0.8% in terms of unit/volume, and we expect this low growth to continue. This means that the volume trend is now going to be more important than value sales growth as an indicator of the current health of food retail over the next few months.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Unless otherwise stated all data is NIQ Homescan Total Till

Unless otherwise stated all data is NIQ Homescan Total Till

1 BRC NIQ SPI Food

2 NIQ Homescan FMCG

3 NIQ Scantrack Consumer View

4 NIQ Scantrack Grocery Multiples

Comments are closed.