One of the most advanced food categories, the yogurt market continues to face new challenges in the form of rapidly rising costs, a swing towards broad-based health in consumer attitudes and softening demand in the economic downturn.

One of the most advanced food categories, the yogurt market continues to face new challenges in the form of rapidly rising costs, a swing towards broad-based health in consumer attitudes and softening demand in the economic downturn.

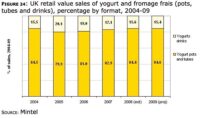

Over the past year, sales in yogurt have grown by 7%, to reach £1,528 million, the value growth partly driven by global dairy price inflation. Spoonable yogurts and fromage frais posted 9% sales growth to reach £1,290 million, fuelled by strong performance from Activia, the relaunched Müllerlight and Onken, among others. Meanwhile, the yogurt drink segment saw sales fall further in 2008, by an estimated 3% to £238 million, still trying to find its footing after the boom and bust of active health yogurt drinks.

Last year saw several key trends in the yogurt market. Brand repositioning saw players build clearer messages and react to consumers moving away from über-functional foods towards overall healthier lifestyles. Limited editions were launched by various brands during the year, providing a testing ground for new flavours and a vehicle to spark interest among users and non-users alike. Many brands extended their presence in the indulgence yogurt category, some through new ranges or repositionings, but many through new flavours under existing brands.

In terms of distribution, grocery multiples dominate the yogurt market, reflecting their strength across wider food retailing. Own-labels are estimated to account for some 16% of the yogurt market, a low share compared to products like desserts, bread and morning goods or milk, where either a high level of NPD (desserts) or a ‘commodity’ nature (bread and milk) have given own-labels a stronger foothold. This largely reflects the very small price differentials between branded and own-label goods in yogurt, with frequent price promotions further helping the brands hold their ground.

While supermarkets offer own-label alternatives across much of the yogurt market, they are followers rather than drivers of innovation, unlike in some other areas, such as chilled desserts.

Used by seven in ten consumers, yogurt and fromage frais enjoy a very high penetration. Overall usage is falling but heavy users are gaining share. Daily usage is highest among the over-65s.

According to exclusive research, a snack at home or eating as a dessert are the most popular occasions for eating yogurt (44% of users each). It has become more popular across occasions since 2007, suggesting growing variety in usage.

Special offers have taken the top position (43%) as a choice factor for buying yogurt, a result of the change in consumer sentiment in the economic downturn.

Nearly four in five consumers view yogurt as healthy, a strength in the current health-focused climate. Meanwhile, just over half see it as tasty, a lower share than actually eat yogurt, which suggests that some people eat yogurt because they think it is good for them rather than for enjoyment.

While some yogurt brands have established themselves as functional, yogurt is mostly seen as a discretionary purchase rather than a necessity. Thus, as consumers cut back on spending in the downturn, demand for yogurt is forecast to soften, with slower growth at 4% estimated for 2009, to £1,590 million. As a small, healthy treat, yogurt will still hold its place in many shopping baskets.

Comments are closed.