VeriFone are international experts in Near Field Communications (NFC) and mobile payments, the payment technologies which are currently grabbing the headlines, and have amassed a significant portfolio of products and services which are available now. VeriFone live at both ends of the mobile spectrum: they deliver mobile point of sale technology that enables merchants large and small to accept card-present payments from anywhere.

VeriFone are international experts in Near Field Communications (NFC) and mobile payments, the payment technologies which are currently grabbing the headlines, and have amassed a significant portfolio of products and services which are available now. VeriFone live at both ends of the mobile spectrum: they deliver mobile point of sale technology that enables merchants large and small to accept card-present payments from anywhere.

VeriFone also participated in the Google Wallet launch earlier this year in the US. Consumers can use their mobile phones with the Google Wallet to make payments via VeriFone’s NFC-enabled payment devices. VeriFone also offer mobile payment devices to enable retailers to make the most of mobile commerce in different parts of the store.

As retailers and consumers look to do more with mobility, they will turn to VeriFone to lead the way, open the door to success at the payment hub and guide them to a bigger world of true mobile commerce. In recent months VeriFone has strengthened its offer with the purchase of Hypercom and Gemalto’s POS business.

Tony Saunders, VeriFone’s Sales & Marketing Director for the NEMEA (North and West Europe, Middle East and Africa) region, spoke to The Grocery Trader.

The Grocery Trader – Tony, in this interview we’re going to concentrate on VeriFone’s expertise in NFC technology, which is very much in the spotlight, but first can we talk a bit about VeriFone overall? We last spoke at the end of 2009. From your point of view, what have the last couple of years been like in your business in the UK? What effect has the recession had on your business?

In the last couple of years we’ve been very successful as a company in terms of maintaining our market share and growing in many verticals. Even though the world has seen a significant recession, VeriFone has ridden it out and grown in each quarter.

GT – Have you changed much as a company since 2009?

We’ve not had any huge internal changes: we went through an internal refresh before the recession started, and since then we’ve been hiring, growing our UK staff numbers by 20%.

GT – You recently bought the Hypercom Corporation. What difference will that deal make to your business? Will Hypercom carry on trading as a separate business?

We completed the Hypercom acquisition on 4 August: we bought the whole business, but have since divested assets in the UK, Spain and US. Hypercom was similar to VeriFone, offering payment devices for retail, banking, and unattended plus software for payment processing and value-added applications.

We completed the Hypercom acquisition on 4 August: we bought the whole business, but have since divested assets in the UK, Spain and US. Hypercom was similar to VeriFone, offering payment devices for retail, banking, and unattended plus software for payment processing and value-added applications.

In a separate acquisition we’ve also purchased Gemalto‘s POS business. This gives us a larger presence in some important markets such as France and increases VeriFone’s representation in several key accounts. Overnight it’s doubled the number of VeriFone POS devices in the banking sector in the UK.

GT – How much time do you (Tony) personally spend in the UK these days?

I spend much more time here than I used to, about 70%. My role has grown to include both sales and marketing, with a lot of the focus here in the UK, in our integrated retail division.

GT – How important is the UK to your NEMEA business?

The UK market is very important to us, and contributes 65% of our NEMEA revenue.

GT – What do you see as the major issues in payments technology in the UK?

Contactless and NFC is a major area of interest at present. Retailers are trying to become contactless-enabled, supported by the card schemes and the banks, but the reality is that many will be reluctant to take on contactless if they’ve just invested in new PIN entry devices, as they need to see a return on those first. The deployment of contactless cards in the UK has grown significantly over the past two years. Visa has projected that they will have 20 million contactless cards in consumer hands by the end of 2011.

Security is always a concern for retailer, and now the overall focus has shifted to cardholder not present transactions, as EMV card fraud in retail has dwindled following the introduction of Chip & PIN.

GT – What are the key products overall in your UK portfolio of electronic payment technologies?

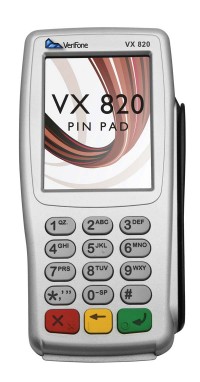

Our key product family in retail is the new VX Evolution range, which includes the VX 820 PIN pad, the countertop VX 520 and the portable VX 680. These are the products that our distributor partners and systems integrators are developing to and the products that retailers are rolling out into the market. The VX Evolution products include features such as contactless and NFC capability, colour and touch screens, fast ARM11 processors and PCI PTS 3.0 approval.

Another important product is our PAYware Mobile Enterprise solution, a card reader/sleeve that slots onto a smart device and enables card payments to be taken via iPhone and or iPod Touch. This product allows staff to take payment anywhere in the store and adds a real “wow” factor to the customer experience. There are many retailers in the UK who want it, especially in the fashion sector.

Finally, our PAYware Merchant card authorisation and settlement software is also a key product. Over 200 high street merchants are using this solution to process high-volume card payments securely and reliably. We also have the PAYware Merchant Managed Service which is a hosted payments platform based on PAYware Merchant, which helps multi-channel retailers reduce PCI compliance issues via outsourced payments management.

GT – What proportion of UK payment card transactions involve VeriFone technologies?

Including e-commerce, it could be as high as 75%.

GT – Turning to NFC now, what is your definition of Near Field Communications? How does it work?

NFC isn’t just about payment, there’s so much more. It comprises three modes: reader/writer mode, peer-to-peer mode and card emulation. Say you have a smartphone with an NFC chip registered to the Google Wallet. You download the Google Wallet to the phone and can save retailer vouchers to keep within the mobile wallet, in addition to your payment information When you go to buy goods at the retailer point of sale, you open up the mobile wallet and tap it against a VeriFone NFC-enabled payment device where you can redeem your vouchers.and decide how you want to pay.

NFC isn’t just about payment, there’s so much more. It comprises three modes: reader/writer mode, peer-to-peer mode and card emulation. Say you have a smartphone with an NFC chip registered to the Google Wallet. You download the Google Wallet to the phone and can save retailer vouchers to keep within the mobile wallet, in addition to your payment information When you go to buy goods at the retailer point of sale, you open up the mobile wallet and tap it against a VeriFone NFC-enabled payment device where you can redeem your vouchers.and decide how you want to pay.

The possibilities are endless with NFC technology. If you’re online and an offer appears, you click on it, indicate your smartphone details and the site sends tokens to your phone, which you go out and redeem. Or when you walk into a retailer who has an NFC tag, perhaps on a poster, you can download the offer and then redeem it at the POS. NFC can really open up new customer experiences and get people excited again about visiting the high street.

GT – Google Wallet sounds a very exciting concept. When’s it coming out here?

At a recent event – NFC Payments Europe – Google said they have plans to bring the Google Wallet to Europe in 2012.

GT – In NFC what distances are involved between the device that’s paying and the terminal that receives the payment?

With Near Field Communication the consumer has to tap their smartphone next to a device that’s NFC-enabled. The device has to get in near proximity to the device, 3cm or less, hence the ‘Near’ in NFC.

GT – With this generation of NFC kit, how close are we now to the dream of buying a Mars bar with your mobile?

We’re getting closer and closer, and the speed depends on the adoption of mobile payments in high street stores. For the consumer the first step is for your phone to have an NFC chip. Second, you have to provision the NFC chip with your bank credentials: the bank must be set up to provide payment. Third, you need a Trusted Service Manager.

GT – There is a contactless transaction threshold in the UK that is £15, when do you see this increasing?

The £15 limit was set for pure contactless card or card emulation via NFC transactions which required no further authentication. Beyond that amount you will still need a PIN or personal code to authenticate payments. The threshold will increase in the future but to what extent and when is down to the confidence of all parties involved in the transaction process, such as the banks, retailers and card schemes.

GT – Are you (Tony) personally involved in getting the message about NFC through to UK retailers? Who else is leading ‘the mission’?

I stand up on my soapbox and talk to many retailers who want to understand what NFC means, and the full benefits it brings. Everyone in the payments industry has a responsibility to put the message across as well. There’s been a distinct change in the language the acquirers and card schemes use about NFC – they’ve moved on from talking about carrying out trials.

I stand up on my soapbox and talk to many retailers who want to understand what NFC means, and the full benefits it brings. Everyone in the payments industry has a responsibility to put the message across as well. There’s been a distinct change in the language the acquirers and card schemes use about NFC – they’ve moved on from talking about carrying out trials.

GT – In non-technical terms what’s the difference between wireless and NFC-enabled devices?

The simplest answer is, an NFC-enabled payment device has an NFC antenna in it. A wireless payment solution can be NFC-enabled or not. A wireless payment device is typically used in hospitality environments and restaurants – it is a portable solution carried by staff to the customer.

GT – What are the different bits of equipment in an NFC-enabled system?

The only thing the retailer needs in order to have NFC is a payment device, such as the VX 820, with NFC turned on inside it. They also need to change the software at the POS. Retailers are always updating their POS systems, and in the scheme of things, changing to NFC is pretty painless.

GT – How does the speed of payment transactions with NFC technology compare with other platforms?

The speed of transactions with NFC should be the same as it is for contactless.

GT – Technologies come in and out of the spotlight. What is the significance of NFC?

NFC isn’t just another method of payment. It is a two-way, real-time communication between the merchant and the consumer that can enhance the payment process. With NFC, merchants and retailers of all kinds can turn their point of sale into a more valuable “point of interaction” with their customers. Couponing, loyalty programs, advertising, digital gifting and more can all be administered effectively and efficiently, using NFC-enabled payment devices.

GT – What are the benefits of NFC for the retailer?

The benefits for the retailer depend on the effort they put in at the start. If they want NFC and as retailers they only implement simple card emulation, there’s no interaction with the consumer and no ability to learn about them, and hence no increase in footfall. The retailer needs to open the POS to pull in more consumers, supporting loyalty schemes, gift cards and so on. Using NFC you can have a two-way conversation: it provides a great marketing opportunity for the retailer.

GT – Does NFC in effect change the way retailers do business?

You’ve got to see NFC in perspective as just another tool: it may not be transformational for a particular retailer, but in general it is a powerful means of communication and getting closer to the consumer. The closer you get to them, the more ‘sticky’ they become and the more business you do.

GT – What proportion of UK card transactions are currently NFC?

I would estimate that less than 1% of transactions are NFC at present. There is only one commercial deployment in the UK, involving Barclaycard and Orange.

GT – How does the UK compare with other countries in EMEA in its attitudes to, and adoption of, NFC?

UK consumers have no idea of what’s on offer. There’s been no real marketing from the mobile operators, banks and acquirers. Consumers need to be informed to get adoption going, and the card schemes will need to spend more.

GT – How secure is the consumer’s payment using NFC technology?

With VeriFone, it’s very secure. The hardware is PCI certified, and so is the app running it. That said, NFC requires retailers to employ payment device best practice and have a clear definition of what their point of sale looks like. They must not allow rogue devices to suddenly appear, put there by fraudsters. Some retailers take photos of what their point of sale should look like, so staff can run preventative maintenance. Others have implemented regular device review programmes.

GT – Who accredits your systems?

We offer NFC technology as a complete solution, with verification agreed between the card schemes and the accepting banks. In every card payment environment, the payment device communicates between the retailer and their acquirer. The accreditation is with the acquiring bank: the payment device has its own accreditation and meets their criteria. The application also has to be fully audited.

We offer NFC technology as a complete solution, with verification agreed between the card schemes and the accepting banks. In every card payment environment, the payment device communicates between the retailer and their acquirer. The accreditation is with the acquiring bank: the payment device has its own accreditation and meets their criteria. The application also has to be fully audited.

GT – What different NFC-enabled devices and customer applications do you offer here in the UK?

We offer the VX Evolution products, which are all ready to go. We are going to accreditation with a number of retailers who are ready to start deployment.

GT – What kind and size of retailers are your NFC devices aimed at?

We cover pretty much every retailer across the board, from the largest down to the corner shop. Quick service restaurants are always an important sector, because they sell low-ticket items and speed is paramount. The second largest deployment in the UK of contactless and NFC-enabled payment devices is VeriFone’s own taxi payment solution. In London’s black cabs we are installing passenger-facing PIN pads that accept all kinds of card payments, including contactless/NFC.

GT – How far have you got with the Tier 1 retailers?

We have confidentiality agreements with various Tier 1 retailers, and the mass rollout of NFC into Tier 1 will happen in 2012. It ultimately comes down to the retailers’ investment.

GT – How does the cost of ownership of NFC compare with Chip & PIN?

Cost is on a par with current PIN entry devices.

GT – How quickly can you implement an NFC solution?

You can complete connection in one day, but accreditation from the acquirer could take up to three months. It all depends on whether the retailer’s already connected to the bank and so on. When the bank has accredited the solution, deployment happens quickly. The available PIN entry devices are pretty standard, but connection to the POS varies in terms of the software and type of integration. Connection could be to the retailers’ data centre or to an outside processor.

GT – Where do you develop the NFC solutions you offer here?

We’re not developers of NFC solutions here in the UK. VeriFone designs our NFC devices in California, and our engineers respond to the different global regions’ requirements.

We’re not developers of NFC solutions here in the UK. VeriFone designs our NFC devices in California, and our engineers respond to the different global regions’ requirements.

GT – What different devices do you offer to enable retailers to carry out mobile payment and NFC in different parts of the store?

In the VX Evolution series, the best product for PIN entry for Tier 1 retailers is the VX 820 PIN pad. For staff walking round the store taking mobile payments they could use the VX 680, which works via Bluetooth, Wi-Fi or GPRS or PAYware Mobile Enterprise. For countertop environments, such as corner shops, VX 820 DUET or VX 520 are ideal solutions.

GT – How often do you update your software?

Updates of our payment software are driven by the bank themselves. We would respond by carrying out an internal process, change the app and send it back to the bank then deploy it remotely via VeriFone’s estate management system. The Tier 1 retailers have similar internal mechanisms. When there are updates we submit files to the retailers, and the POS system updates it. There’s no need to return devices to the supplier to complete application updates.

GT – What are your projections for the speed of rollout of NFC? Where do you see NFC going from here?

It could go one of two ways. Consumers will love NFC and embrace it, so usage could skyrocket up to 70% of transactions. Or it will be slow burner with around 15% adoption. I think it really comes down to how retailers decide to implement the technology and how creative they are.

GT – Finally, where do you see VeriFone as a business going from here?

VeriFone’s growth will continue, especially in key verticals such as retail, self-service, hospitality and financial services. VeriFone remains committed to advising merchants about new payment technologies and we predict some exciting times ahead. It’s going to be a busy 2012!

Tel: 01895 275275

Comments are closed.