The toys and games market experienced a tough couple of years in 2008 and 2009, with value sales depressed by fierce retail price inflation among leading players in the market. With the UK economy heading into recession in late 2008, there was already widespread discounting taking place and the collapse of high street giant Woolworths only made matters worse in the lead up to Christmas, the toy sector’s most crucial trading period. By Q4 2009, prices were showing signs of recovery and the sector was able to report a much-improved Christmas performance, laying the foundations for growth during 2010.

The toys and games market experienced a tough couple of years in 2008 and 2009, with value sales depressed by fierce retail price inflation among leading players in the market. With the UK economy heading into recession in late 2008, there was already widespread discounting taking place and the collapse of high street giant Woolworths only made matters worse in the lead up to Christmas, the toy sector’s most crucial trading period. By Q4 2009, prices were showing signs of recovery and the sector was able to report a much-improved Christmas performance, laying the foundations for growth during 2010.

The toys and games market is highly focused on discounting and special offers and intense retail competition has limited price rises. Although the cost of goods to retailers has risen due to imports from China in particular becoming more expensive, retailers have found it difficult to increase retail prices.

Following two tough years in 2008 and 2009, the toys and games market has returned to value growth in 2010, with the market estimated to grow by 5% to just under £2.2 billion.

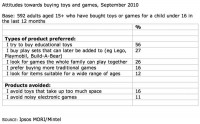

Buying toys and games tends to be a mixture of planned purchases after asking what a child wants and impulse buying when seeing something that appeals while in the shop. Special offers play a big part in shopping for toys and games, and nearly three in ten adults make the most of promotions such as three-for-two. One in five adults say they are influenced by what their child/grandchild wants in the shop, demonstrating the extent to which some people give in to pester power.

Retailers need to use the information they have on their customers purchasing patterns more effectively, and let them know about special offers on products they are most likely to be interested in buying. Some 28% of toy buyers make the most of special offers.

The convergence of internet and TV technology will open up big opportunities for promoting toys and games. Currently three in ten toy buyers (29%) browse the internet to compare products and prices and a quarter (24%) look through catalogues before buying.

Bringing toys and games to life in-store can inspire shoppers to purchase items they might not otherwise have considered buying. Just under a quarter (24%) of toy buyers would be encouraged to shop more at a particular store if they were able to test/play with the toys before buying.

The more a toy retailer can do to guide consumer choice in its stores the better. A quarter of toy buyers (26%) would be encouraged to shop more at a particular store by a list of best sellers by age group, one in five (21%) by an area of gift ideas by price and 17% by a pocket money area.

The educational element needs to be simply explained to shops for toys and games and this could be clearly demonstrated by showing small video clips in stores and on websites. Some 56% of toy buyers try to buy educational toys.

Comments are closed.