New research from Mintel into Seasonal Drinking habits finds that beyond temperature, seasonal factors play little role in consumer alcohol purchase decisions.

New research from Mintel into Seasonal Drinking habits finds that beyond temperature, seasonal factors play little role in consumer alcohol purchase decisions.

The report looks into average seasonal household spend on alcohol over the past four years, and concludes that the general pattern is for increased spend as the year progresses, with October-December registering the largest uplift in sales on account of the festive period.

Indeed, wine and spirits increase their share of sales in the autumn and winter months (October-March), whilst beer’s refreshing properties prove an exception to the rule, as it gains greater share in the warmer months.

Overall, spend on alcohol is 21% higher than average in the final three months of the year, thanks to the festive season where drinking is virtually a national duty. Accordingly, advertising is at its most competitive at this time of year with average yearly expenditure over the past four years at £81 million, 25% higher than the quarterly average.

Despite seasonality being a recurring theme of drinks advertising, Mintel’s consumer research finds limited evidence that people’s choice of drink changes based on seasonal considerations. What does make a difference is whether the drink tastes good when served cold, with this being an important consideration for 55% of people when buying a drink in spring/summertime. Meanwhile, only a quarter (26%) of consumers consider this to be a key consideration in autumn/wintertime. In fact, tasting good when served cold is more important than whether a drink tastes good served at room temperature.

Young men are particularly appreciative of drinks that are cold, regardless of the season, largely because they are more likely to drink beer and this explains why extra-cold variants of beer have done particularly well.

On the other hand, women are more likely than men to be influenced by drinks they associate with seasonal occasions, ie Baileys at Christmas and Pimm’s in the summertime. This suggests that women are a better target for seasonal drinking than men, who tend to have a drinks preference and stick to it all year round.

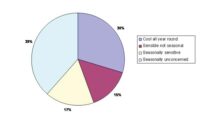

Almost a third of us, three in ten consumers enjoy cool drinks at all times of the year. This group is most likely to be male and aged 18-44, while four in ten do not care about seasonality, with only a fifth seasonally sensitive. The latter are especially likely to be women.

The best season for return on investment is January-March (winter), where £1 million of above-the-line advertising spend helps to generate £100 million of household expenditure on alcohol. In contrast, £1 million of advertising spend in the October-December quarter equates to only £53 million of spend. In other words, advertising spend declines considerably after the Christmas and New Year period, but alcohol sales remain relatively strong.

The report concludes that although drinking does drop off after New Year’s Eve, sales in winter still account for 21% of the total year’s alcohol sales. Whilst January is often a dieting/detoxing month for many, it is worth the risk for advertisers being bolder by communicating more in February and March. There is less advertising clutter and consumers could respond well to a message that it is okay to indulge again now that the festive period is a distant memory.

Comments are closed.