Over the past five years alone, sales of pasta, rice and noodles have increased 41% as this year British consumers will munch their way through £1.4 billion pounds worth of the stuff. And despite global rice and pasta shortages pushing up the price of these store cupboard staples, total sales of this trio have increased by just over 22% in the past 2 years alone, with much of the growth taking place between 2008 and 2009. What is more, the market for pasta, rice and noodles is set to grow a further 25% between 2009 and 2014, reaching £1.8 billion by 2014.

Over the past five years alone, sales of pasta, rice and noodles have increased 41% as this year British consumers will munch their way through £1.4 billion pounds worth of the stuff. And despite global rice and pasta shortages pushing up the price of these store cupboard staples, total sales of this trio have increased by just over 22% in the past 2 years alone, with much of the growth taking place between 2008 and 2009. What is more, the market for pasta, rice and noodles is set to grow a further 25% between 2009 and 2014, reaching £1.8 billion by 2014.

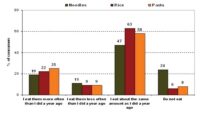

Rice and pasta prices rocketed in 2008 due to global shortages and the weakness of sterling. Despite this, greater interest in home cooking and the move towards more dining in during the recession have helped boost sales. This, together with the influence of global cuisines and demand for convenience has helped drive sales of pasta, rice and noodles.

Value sales growth has also arisen from product innovation. New Product Development has mirrored this success, with Mintel’s Global New Products Database revealing new pasta, rice and noodle products are up 31% over the past three years. Indeed, in the first six months of 2009, there have already been 132 new product launches across all three categories. This compares to 175 launches throughout the whole of 2008. Manufacturers are responding to unabated demand for convenience, with microwaveable and/or quick-cooking noodles, rice and pasta also proving popular focuses for NPD.

New product development such as microwavable rice pouches and a trend towards new launches at the premium end of the market have held consumers’ interest and encouraged new meal ideas for pasta, rice and noodles. Pasta-based fare, curries and stir-fries are therefore increasingly replacing traditional British dishes as consumers become more adventurous with their food, and look for quick and easy to prepare dishes.

At present about 85% of the UK population is eating dried pasta, and almost 28 million adults feel it is a cheap meal solution. However, while the market for pasta (including ready meals) is worth £811 million in 2009 – more than rice and noodles combined – the highest value growth has come from rice, up 32% against increases of 21.4% for pasta and 11.5% for noodles between 2007 and 2009.

The research also highlights Briatin’s unabated devotion to dry pasta, with 77% of Brits eating this type. Its nearest rival, fresh pasta came in at 46%. Healthy pasta attributes are not as high on consumers agenda, with 8% saying they eat organic pasta and just 4% gluten or wheat free. Demonnstrating its place in our eating habits, just 3% of Brits said they found pasta to be bland and unadventurous.

In Noodles, dry egg noodles have topped the list in the favourite type eaten by Brits, with nearly half of consumers eating this type. Its nearest rival – instant meals such as Pot Noodle – eaten by at least a third of consumers and ahead of other types such as ready to cook, fresh and restaurant or takeaway noodles.

In terms of rice, it seems Brits are favouring long-grain white rice, with 59% of consumers saying they eat this types, closely followed by Basmati at 57%. However, it seems speciality rice is less appealing, with just 8% saying they each types such as wild or black rice. Proving no brand loyalty, 44% of Brits said own label rice is as good as branded rice and 30% said they normally pick the cheapest type.

Comments are closed.