Despite the recession, the cat and dog food market has remained robust: in 2009, the market grew by 4% to reach £1.8 billion. By contrast, volume sales have remained fairly static largely due to the move away from wet to complete dry food. The increasing popularity of smaller dogs that require less food has also affected volume sales. Despite the move to dry food, many consumers believe wet food is healthier and more appetising for their pet, particularly for the smaller dog.

Despite the recession, the cat and dog food market has remained robust: in 2009, the market grew by 4% to reach £1.8 billion. By contrast, volume sales have remained fairly static largely due to the move away from wet to complete dry food. The increasing popularity of smaller dogs that require less food has also affected volume sales. Despite the move to dry food, many consumers believe wet food is healthier and more appetising for their pet, particularly for the smaller dog.

Value growth has been driven by premiumisation. Trends identified across both markets that are encouraging consumers to trade up include single-serve pouches (particularly for cats), organic and natural ingredients, additive- and preservative-free products, super-premium products and an increasing interest in provenance of ingredients.

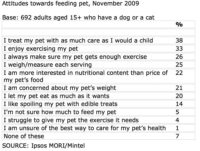

Pets play an important role in their owner’s lives and are commonly regarded as a valuable member of the family; as such owners are loath to trade down when it comes to feeding their pet in the same way that parents do not compromise their children’s food.

Nevertheless, consumers are becoming increasingly concerned with value for money. As a result, manufacturers are adding value to their mid-range brands by introducing new gourmet recipes and redesigning packaging.

Whilst treating a pet with as much care as a child suggests that the pet is well looked after, there is a worrying flipside to this. Pets are animals and as such have no need to be treated like a child; the humanisation of pets is leading to a greater incidence of pet obesity. Overfeeding, too many treats and lack of exercise are commonplace, leading to a range of health problems.

Indeed, pet obesity is rising, with an estimated one in three household pets now overweight. Many owners feel their pets have the same emotional and physical needs as humans. The result? Overfeeding and under-exercising is commonplace.;

Manufacturers are cashing in on our desire to humanise our pets by developing products that mirror human tastes, such as the Winalot Roast dinner range, gravy for dry food, and recipes for cats that include ingredients such as Black Tiger Prawns.

In terms of distribution, the major supermarket chains are the largest and most important channel of distribution for pet food, particularly in the wet food segment, accounting for approximately two thirds of the market. Independent pet stores serve an important role in servicing local communities and neighbours and in catering for a more demanding or specialist customer. Taken together with the pet superstores, which serve a broader customer base and offer the largest range of products, this channel accounts for close to 15% of the market.

New developments in the US that are set to break into the UK market: restaurant-style dog meals such as Tuscan Style Stew with Braised Beef, celebrity chefs creating dog food ranges and the first national brand of refrigerated dog food.

When choosing a pet food, 14% of pet owners opt for the highest quality available whereas 9% choose the cheapest available.

Comments are closed.