The alcoholic RTD (ready to drink) market blossomed in the 1990s, through the likes of Smirnoff Ice and Bacardi Breezer, but has since been fighting a rearguard action. With FABs (flavoured alcoholic beverages) subject to vastly increased duty in 2002, sales have been in decline ever since.

The alcoholic RTD (ready to drink) market blossomed in the 1990s, through the likes of Smirnoff Ice and Bacardi Breezer, but has since been fighting a rearguard action. With FABs (flavoured alcoholic beverages) subject to vastly increased duty in 2002, sales have been in decline ever since.

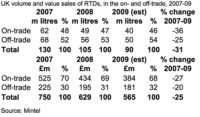

Despite volume sales of 286 million litres in 2004, by 2009 FABs saw only 81 million litres sold – a huge (72%) decrease. The market has suffered from the fact it has never fully shaken off an association with underage drinkers, while lack of innovation has made the category seem out-dated, and – WKD aside – the category has struggled to appeal to men.

But now, with more and more people drinking at home in response to off-trade prices being much lower than drinking out, a gap in the market has emerged again for RTD drinks which conveniently replicate the on-trade drinking experience but at home.

Pre-mixed spirits, such as gin and tonic in a can, and cocktails like Bacardi Mojito in a bottle are the new generation of RTDs. They have only emerged recently but already look set to capitalise on this changing market dynamic. Mintel’s research shows they appeal to an older and more sophisticated target audience, and they can capitalise on the current popularity – and lack of knowledge of how to make – cocktails in particular.

Exclusive consumer research shows that Brits view these drinks in a completely different light from FABs, perceiving them as more sophisticated and suitable for an older audience. However, key to their long-term success will be in the tasting. No matter how convenient a ready-made Cosmopolitan is, people will not be prepared to pay for a poor imitation, which tastes only half as good as a freshly made one.

Despite RTDs being sold in greater volume in the off-trade, the on-trade – and pubs and clubs in particular – accounts for the vast majority of value sales, reflecting the fact that RTDs are more than three times more expensive in value when drinking in the on-trade.

Within the off-trade, multiples have consolidated their power and Tesco in particular supplies a large proportion of RTD volume sales. However, the decline of RTDs and the success of cider and perries, not to mention supermarkets being keen to be seen as clamping down on underage drinkers, has meant a decreasing amount of shelf space available to the category.

Pre-mixed cocktails, like pre-mixed spirits are sold almost entirely in the off-trade channel but cocktails in particular have real potential to provide a much-needed shortcut for those pubs and bars that have a high footfall, and do not have the time to make them on the premises.

Comments are closed.