Alcohol consumption in the UK has been in decline since 2004, as consumers seek to cut down on the amount they drink because of changing economic, demographic, health and social trends.

Alcohol consumption in the UK has been in decline since 2004, as consumers seek to cut down on the amount they drink because of changing economic, demographic, health and social trends.

This changing drinking behaviour has also resulted in a shift towards the home and away from the on-trade, as consumers look to save money. Almost 75% of consumers buy alcohol from the supermarket, while 68% of consumers have bought or drunk it in pubs and bars.

In-home drinking has, however, suffered since the credit crunch hit in 2008, dropping 2.2 percentage points between 2006 and 2010 (see Market Environment), although this was less extreme than the 8.2 percentage-point drop seen in out-of-home drinking.

The prospect of minimum pricing for alcoholic drinks solicits a powerful response from consumers, with seven in ten believing that raising the cost of alcohol at the supermarket would penalise standard drinkers. This is despite the majority admitting it would have little or no effect on their alcohol purchasing.

Consumers spend an average amount of £12 per week at the supermarket, translating into £624 a year, although almost one quarter spend £5 or less per week, indicating that a binge drinking culture in Britain may not be as widespread as the media suggests.

A third of consumers are influenced in their choice of supermarket based on who has the best offers of alcohol, a testament to the success of alcohol as a potential loss leader.

While consumers in general are strongly engaged with discounting, with four fifths having bought alcohol on promotion in the past 12 months, the over-45s, who are the key demographic for in-home drinking, are the least likely to buy alcohol on promotion.

While raising the price of alcohol in supermarkets would close the gap between the on- and off-trade, it would have little impact on driving consumers back to the pub, as only 11% of consumers agree that higher prices at the supermarket would make them drink in pubs more often.

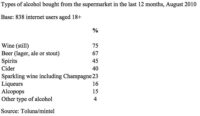

Wine is the most popular drink of choice, suggesting that they are either drinking on just one occasion or making one purchase last for a couple of evenings. Wine is most popular among ABs, women and the over-55s, while penetration of beer peaks among men, the D socio economic group and those aged between 25 and 54. The supermarkets have therefore been keen to push their wine ranges through advertising, featuring in six out of the top ten brands over the past two years.

Wine is a safe choice for in-home consumption, being a compromise option between the sexes, the drink most associated with relaxing and an ideal gift when visiting friends. It also appeals to consumers who are looking to save money and who are creatures of habit.

Comments are closed.