Until recently, the bottled water market was thriving, more than doubling its volume sales in 10 years to reach 2.5 billion litres in 2007. However, a fall in consumer confidence, and poor consecutive summers saw volume sales fall by 11% between 2006 and 2008. With the industry attracting environmental criticism and consumers seemingly happy to exchange bottled for tap water, some were predicting the market to be in terminal decline.

Until recently, the bottled water market was thriving, more than doubling its volume sales in 10 years to reach 2.5 billion litres in 2007. However, a fall in consumer confidence, and poor consecutive summers saw volume sales fall by 11% between 2006 and 2008. With the industry attracting environmental criticism and consumers seemingly happy to exchange bottled for tap water, some were predicting the market to be in terminal decline.

However, this does not appear to be the case as in 2009, the decline in sales slowed to only 1% with the British drinking 2.3 billion litres of bottled water and the market worth £1.9 billion. With economic conditions expected to improve, Mintel forecasts that volume sales will start growing steadily from 2011 onwards and that by 2014 the British will once again be consuming 2.5 billion litres a year.

Today, over a third of consumers in Britain (35%) think that bottled water tastes better than tap water. However, Mintel’s research shows that there is still a huge question mark over whether bottled water is good value, even among its drinkers. Only one in ten think of it as value for money, a third think it is “a bit of a con” and four in ten think it is no healthier than tap water.

Mintel also finds little evidence of environmental concerns affecting purchasing. Only one in eight (12%) admit their purchase decision is influenced by whether a brand is locally sourced to reduce the carbon footprint, compared to 28% influenced by whether the bottle is easy to carry. Also, despite one in six (16%) of bottled water drinkers agreeing that buying the product is bad for the environment, only a third opt for environmentally friendly brands, compared to over a half who opt for the cheapest price.

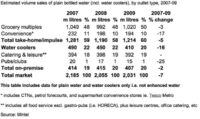

In terms of distribution, the supermarkets have benefited from market conditions, with falling consumer confidence, their strategy to discount heavily on bottled water and the fact that consumers can buy in bulk seeing their share of the in-home and impulse market rise to 50%.

Meanwhile, convenience stores have seen a slight decline in share as people have generally become less impulsive and more planned in their purchases, a strategy which ensures they are careful with money.

Despite three in five consumers becoming more cautious in their spending habits when eating out, and consumers being increasingly willing to ask for tap water in restaurants, the catering and leisure sector is performing well.

Comments are closed.